Table of Content

Do you wish to remove payment methods on Venmo that you no longer use?

Whether you have switched to a different bank or canceled a credit card, this comprehensive guide shows you how to effortlessly delete payment methods from the Venmo app, giving you more control over your financial data.

What is Venmo?

Venmo is an American mobile payment service launched in 2009 that has been owned by PayPal since 2013.

Venmo is aimed at individuals who want to share and pay their bills or shop online. Account holders can use a mobile phone app to transfer payments to others. However, both the sender and the receiver must be US residents to use Venmo hassle-free.

Venmo also functions as a mini social network, allowing users to view other users' public transactions via posts and emoticons. In 2021, the company completed $230 billion in transactions and earned $850 million in revenue.

Why Is It Important to Remove a Payment Method from Venmo?

There are several reasons why deleting unused payment options from Venmo is a smart idea. Some of them are as follows:

Enhanced Privacy

Connecting fewer payment methods to your Venmo account reduces the attack surface for illegal transactions. If someone gains access to your Venmo login, they will have fewer possibilities to steal your hard-earned money or attempt identity frauds.

Reduced Chance of Unexpected Charges

With fewer payment options, you are less likely to use an expired card or an account you no longer use. This can help you avoid declined transactions and possible excessive costs.

Improved Account Control

Having a clean Venmo account with only the payment methods you actively use makes it easier to track your spending while organizing your funds within the app.

Even if you believe a payment method is secure, there is no harm in removing it if you are not using it anymore. You can manage your transactions easily if you keep your Venmo account clutter-free and limited to the essentials.

How to Remove Your Payment Method from Venmo

- First of all, go to venmo.com.

- Log in to your account by clicking on the Login button on the upper right side of the screen.

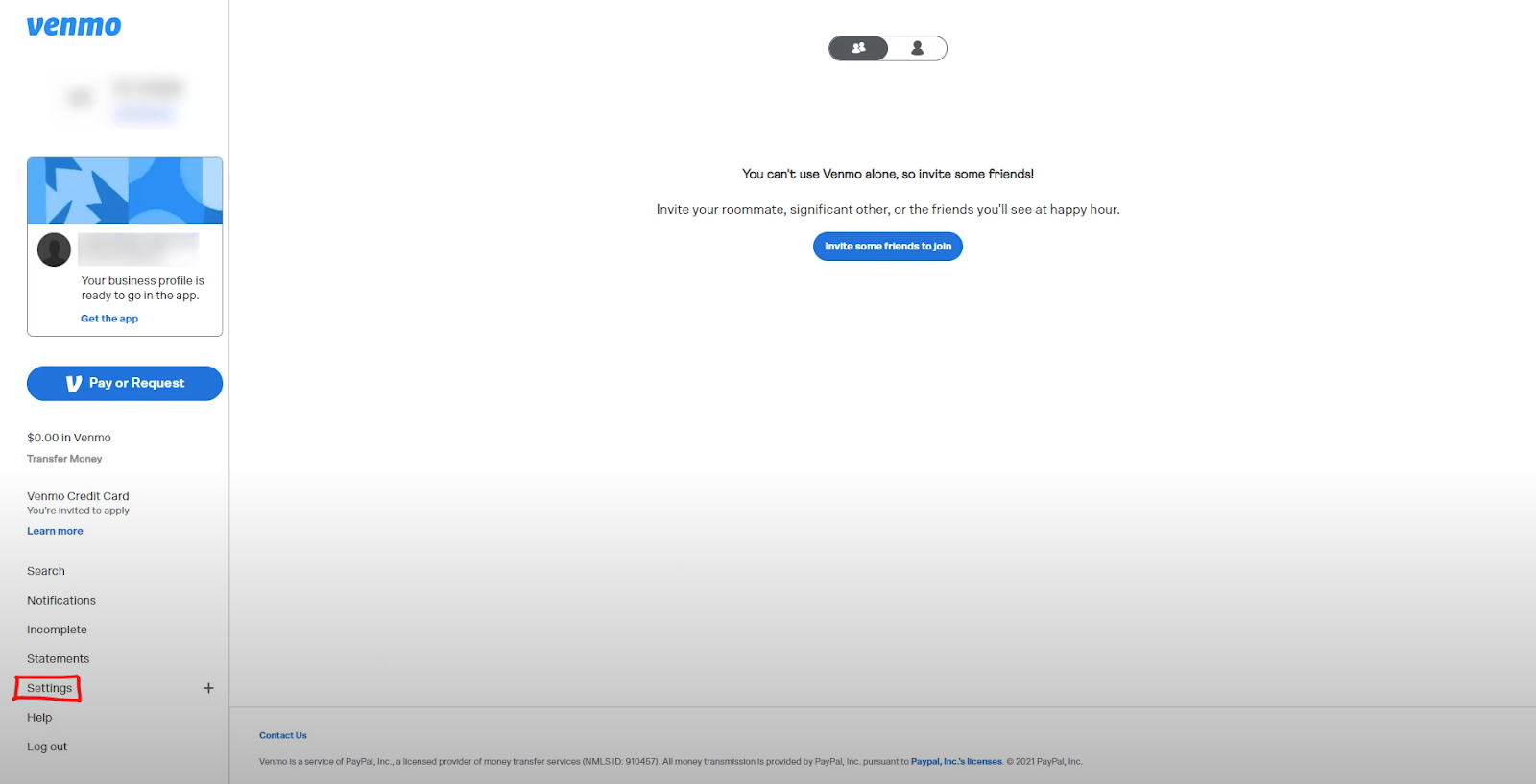

- Once you log in, you will see several options on the left side of the screen.

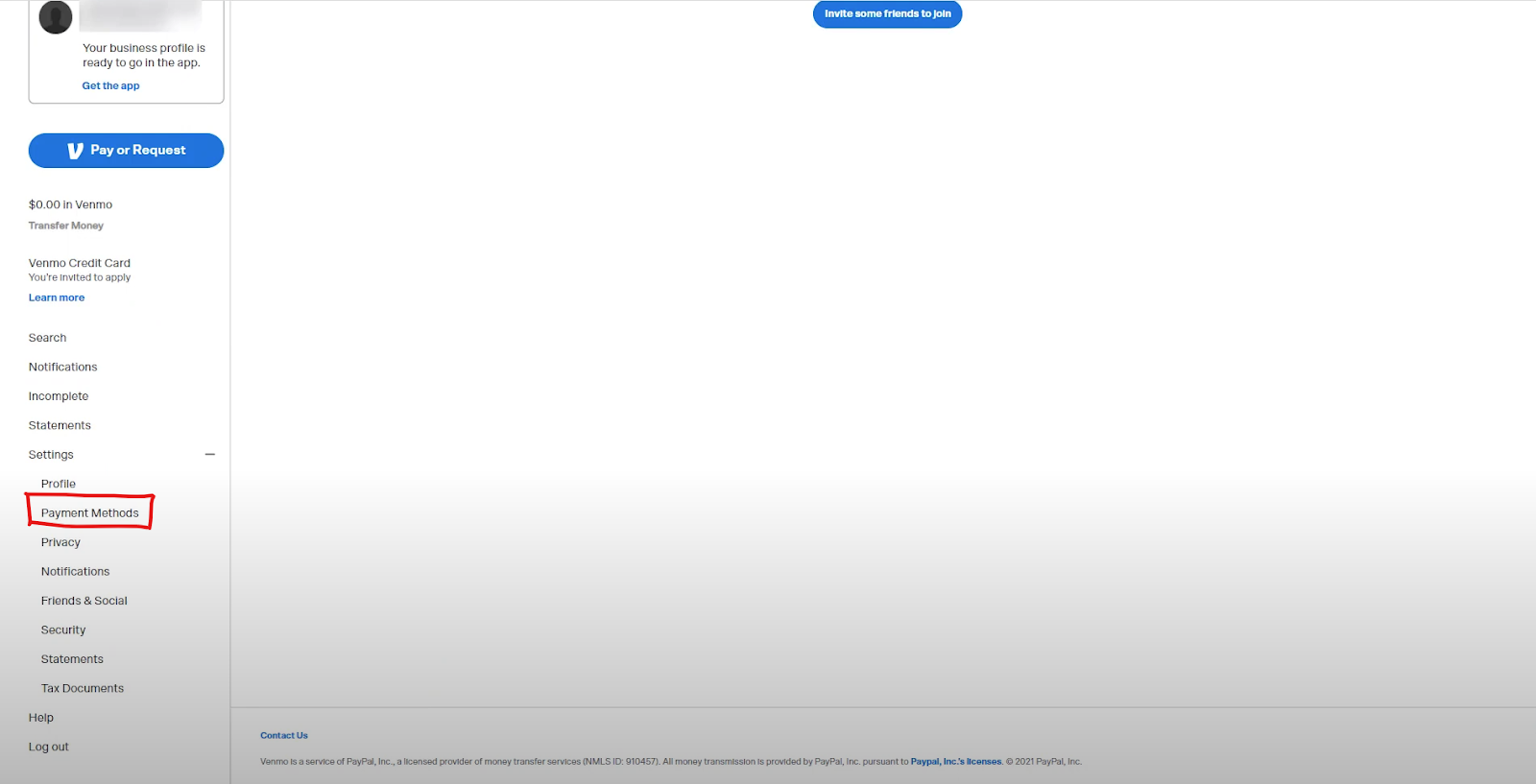

- Simply click on the Settings option.

- Under settings more options will appear, click on the option that says Payment Methods.

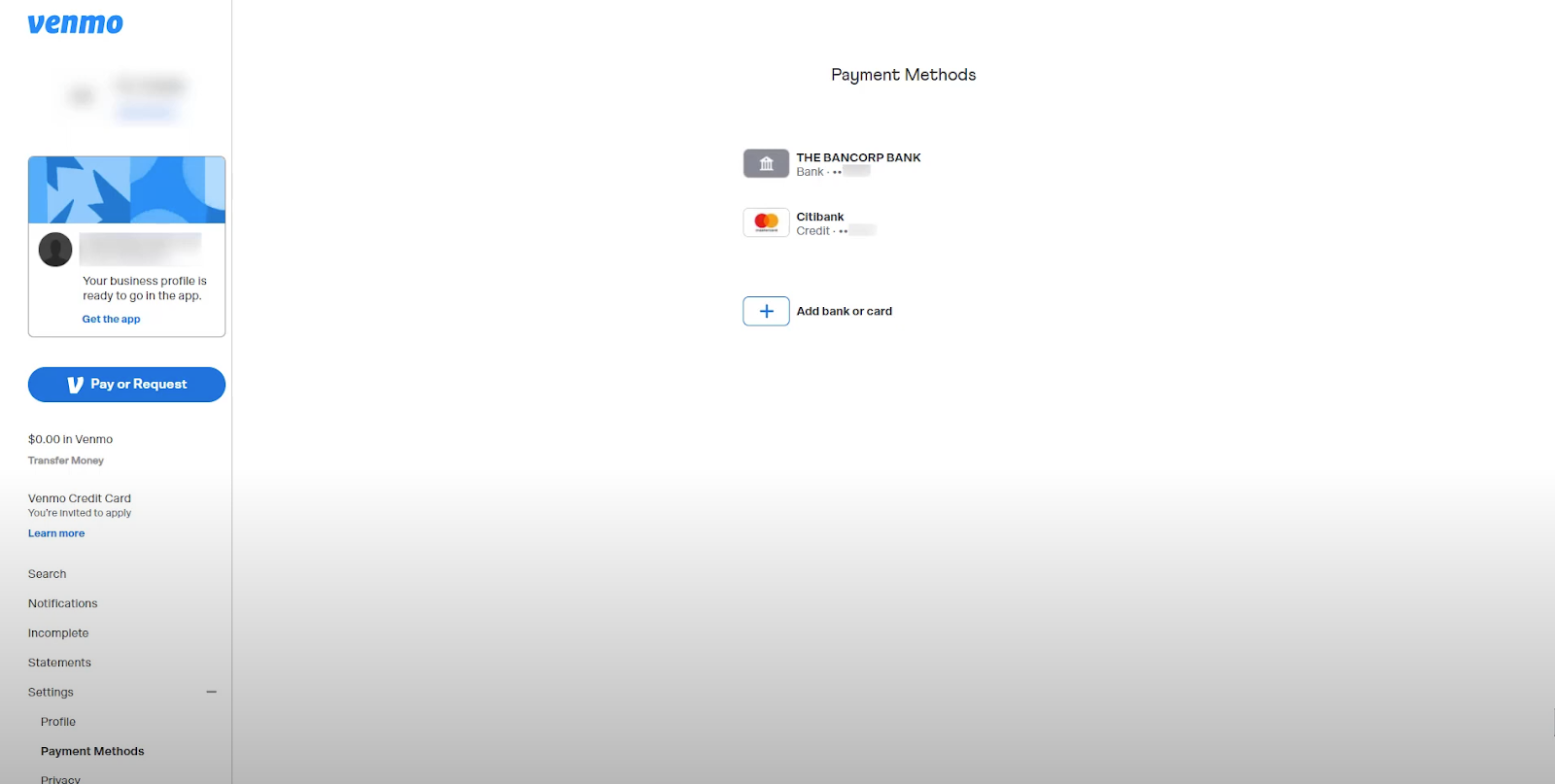

- After that, on the next page, you will see the list of your payment methods.

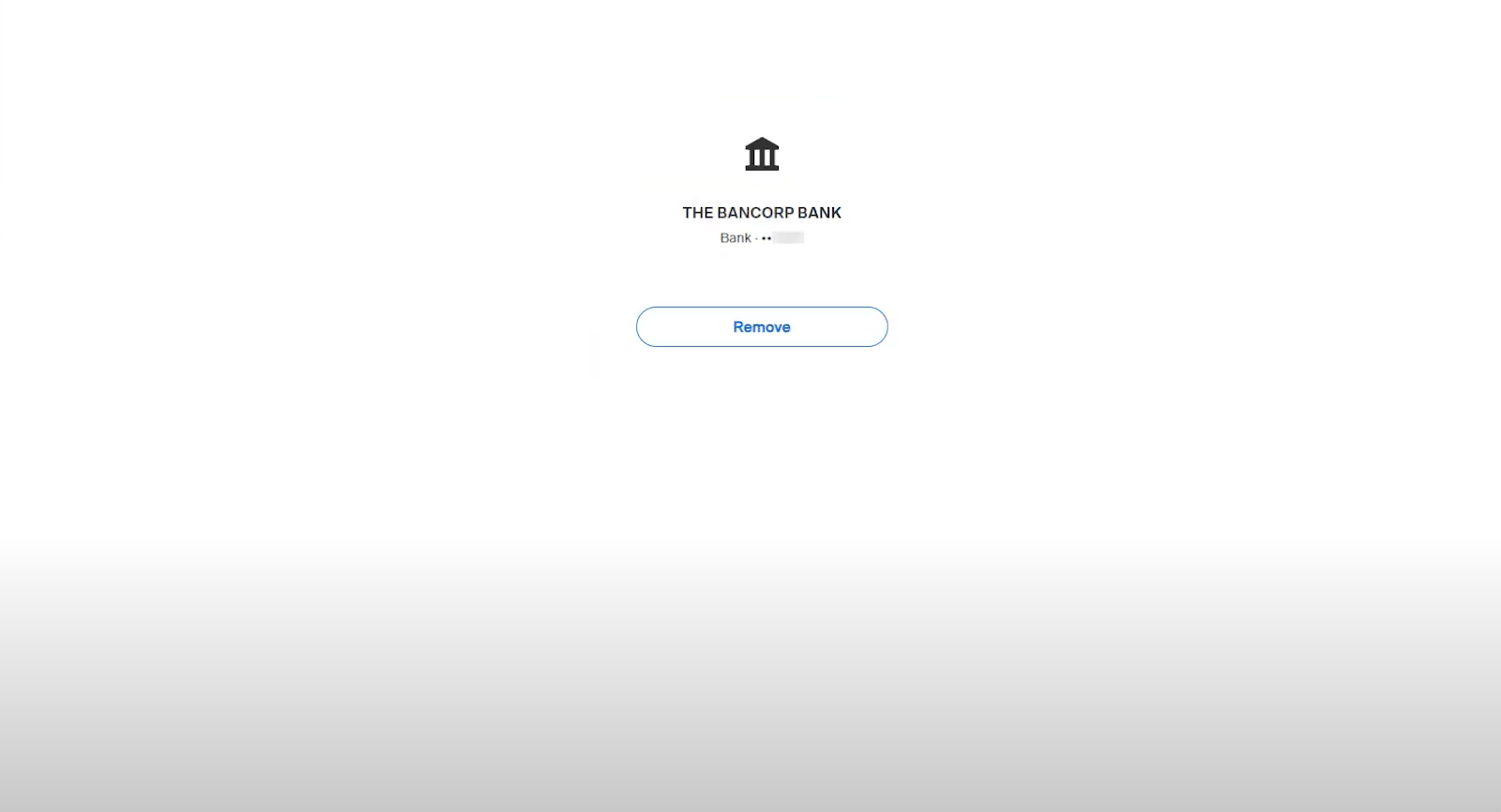

- Click on the payment method you wish to remove.

- Then you will see a Remove button, click on it.

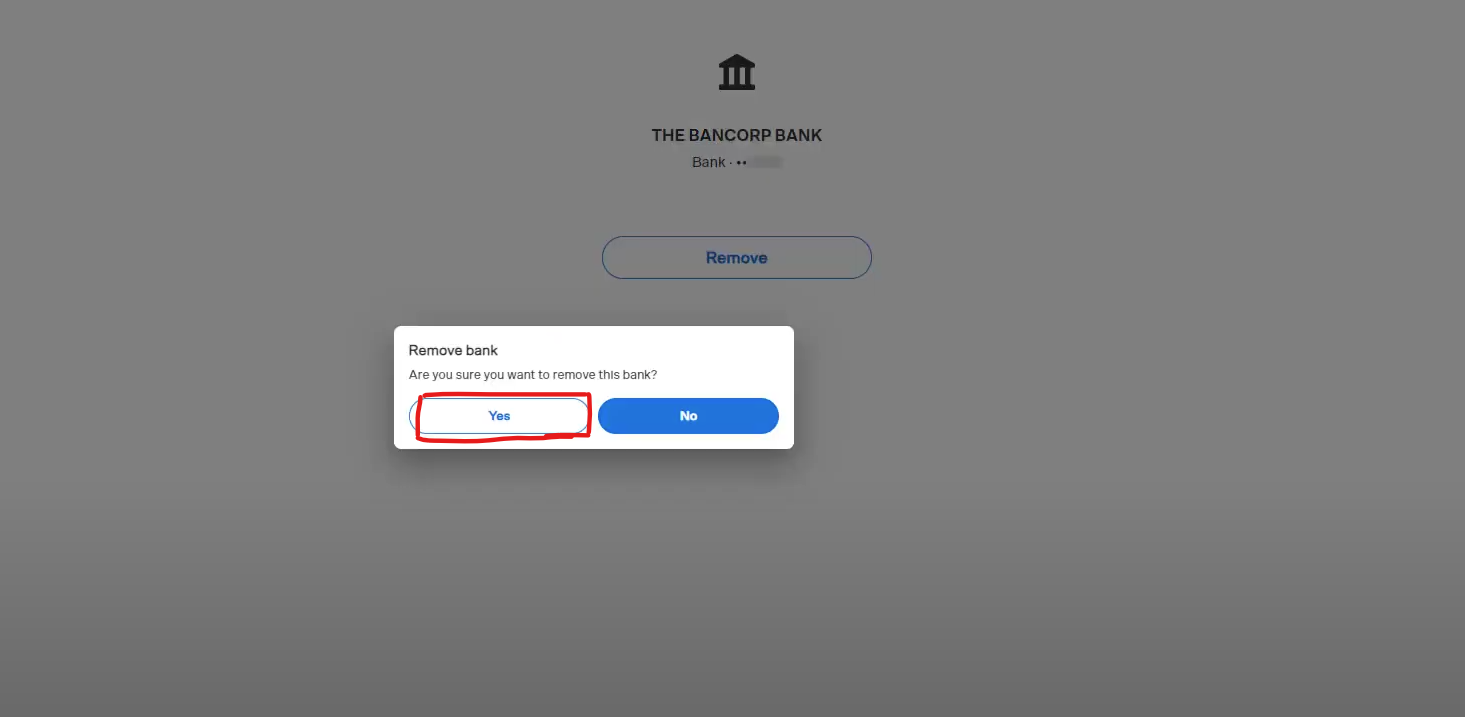

- A pop-up message will appear asking if you are sure to remove a payment method.

- To proceed click on the Yes button.

Congratulations! That is how you can successfully remove the payment method from your Venmo account.

What Happens When You Remove Credit Card Details Venmo?

When you delete a payment method from Venmo, the following occurs:

Restricted Payment Options

- You will not be able to use the deleted payment method for further Venmo transactions.

- When sending money through Venmo accounts, you will need to use a separate payment method.

Use of Venmo Balance

- If you have a Venmo balance, the platform might try to make payments from that balance before using money out of the other associated payment methods.

Transferring Funds (Fees May Apply)

- Removing your bank account will not affect your ability to use Venmo, but it will limit your options for free transfers of your Venmo balance to your bank account.

- Standard transfers are likely to come with a fee.

- Instant transfers may still be achievable with a linked credit card, although there is usually a fee involved.

The bottom line is that removing a payment method does not disable your Venmo account. However, it does change the way you make payments and manage your Venmo balances.

Is Venmo a Safe Platform?

The short answer is yes. When sending and receiving money to friends or loved ones, Venmo can be a secure platform, but it is important to take precautionary measures.

Although Venmo uses safety measures to store and protect your information, there are still certain dangers lurking online. Using Venmo with strangers is the main source of concern when it comes to financial frauds.

You should be cautious of scammers as Venmo prioritizes social connections over strong buyer protection. Use Venmo exclusively with someone you can trust, keep your transaction details private, and remove unused payment methods to reduce security risks.

Strangers (potential scammers) can take advantage of security flaws in apps like Venmo by creating fake profiles or using social engineering techniques to trick you into sending them money.

You can lower your risk of using Venmo even more by limiting the amount of personal information you share publicly. But the security flaws go beyond Venmo and other online platforms. Malicious actors might try to gather information from multiple sources to create a profile.

And, this is where a tailored privacy solution like PurePrivacy comes in. It can analyze your social media accounts and recommend privacy settings that reduce the data you share online. You can make it difficult for cybercriminals to create your profiles by controlling your digital information.

Protect Your Online Privacy

PurePrivacy offers comprehensive online security and privacy solutions, allowing you to manage your online presence and secure yourself against growing risks.

Here’s What You Get:

Social Privacy Manager

- Assess all of your accounts and suggest the most effective solution.

- See how your private data is shared and take action against it.

- Check social media accounts and make privacy tweaks.

Privacy Settings

- View the results of your privacy checkup alerts on a customized dashboard.

- Decide how frequently PurePrivacy should examine your settings.

- Delete all of your social media activity history.

Remove My Data

- Remove your private data from 200+ data brokers.

- Protect yourself from the dangers of targeted marketing, and online frauds.

Tracker Blocker

- Stop unwanted tracking of your online activities with a Tracker Blocker.

- Protect your private data from targeted profiling according to your demography.

- Ensure that your personal information remains in safe hands.

- Use any app and visit any website you like by staying anonymous online.

Frequently Asked Questions (FAQs)

-

How to remove a bank account from Venmo?

To unlink a bank account, in Venmo, tap your profile photo and then the gear symbol. Select a bank account and then select Remove. If you unlink your bank account, you will be unable to transfer your Venmo money to it for free.

-

Why will Venmo not allow me to change my payment method?

When you send a payment using Venmo, the money is allowed to be deducted from the chosen payment method and made accessible to the recipient. It is always recommended that you double-check your payment method before sending a payment.

-

Can you disable the Venmo card?

Yes, you can disable the card. If you feel your Venmo card has been lost or stolen, you can disable it immediately using the Venmo app. If you have disabled the Card or do not have the Venmo app, reach out to Venmo support reps at 855-204-4090 for further assistance.

Experience Secure Banking

Venmo is an easy way to send and receive money with friends, but security should always be your priority.

By deleting unused payment methods, keeping transactions private, and using an app like PurePrivacy to control your online presence, you can reduce online frauds.

Remember that a secure banking experience requires both careful Venmo usage and a good online privacy posture.