Table of Content

- What is 700Credit?

- How Does 700Credit Gather My Information?

- Why Is It Important to Opt-Out of 700Credit?

- How to Opt-Out of 700 Credit the Right Way

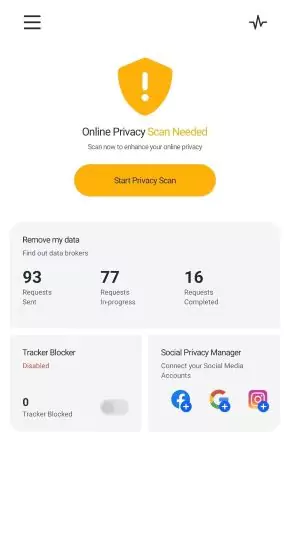

- Remove Your Personal Information Using PurePrivacy

- Steps to Opt-Out Using PurePrivacy

- Manually Opt-Out Method Vs. Opt-Out With PurePrivacyÂ

- Frequently Asked Questions (FAQs)

Cyberattacks are serious and aren’t stopping any time soon!

In 2020, CISA reported over 65,000 attacks.

Cyberattacks can cause big damage, not just to your money but also to how others trust you. It's important to stay safe online and shield yourself from these risks.

Learn how to remove all your information from 700Credit, regain control of your online identity, and keep yourself safe from a big privacy problem.

What is 700Credit?

700Credit isn't a credit score. It's a company that helps car dealerships by providing them with credit reports to see if customers can get loans.

They also offer tools to make sure dealerships follow rules and services to guess a customer's credit score without affecting it.

How Does 700Credit Gather My Information?

700Credit doesn't gather your information directly. It helps dealerships get your credit report, so the information collection happens at the dealership.

Credit Bureau Authorization

When you ask for a loan at a dealership, you let them check your credit report from big credit bureaus like Equifax, Experian, and TransUnion.

Dealership Request

The dealership sends your details (like your name and Social Security number) to 700Credit, who then connects with the credit bureaus.

Credit Report Retrieval

700Credit gets your credit report from the authorized bureaus and gives it to the dealership.

Dealerships must follow the law (FCRA) when getting your credit report. They need your permission before asking for it.

Why Is It Important to Opt-Out of 700Credit?

Choosing not to share your credit report for dealership financing is separate from opting out of 700Credit. Here's why it's important:

Privacy Concerns

Sharing your credit report means sharing private money details. Opting out lets you decide who sees this information and when.

Multiple Inquiries

Hard inquiries, which check your full credit report, can temporarily lower your credit score. Opting out reduces the number of these inquiries for dealership financing.

Preparation Time

Opting out lets you decide when to get financing. You can check your credit report early and fix any problems to boost your score before getting a loan.

How to Opt-Out of 700 Credit the Right Way

To opt out of 700credit.com, just email them at [email protected] and ask them to opt out. They'll take care of the rest!

And that's how you can opt out of 700Credit.

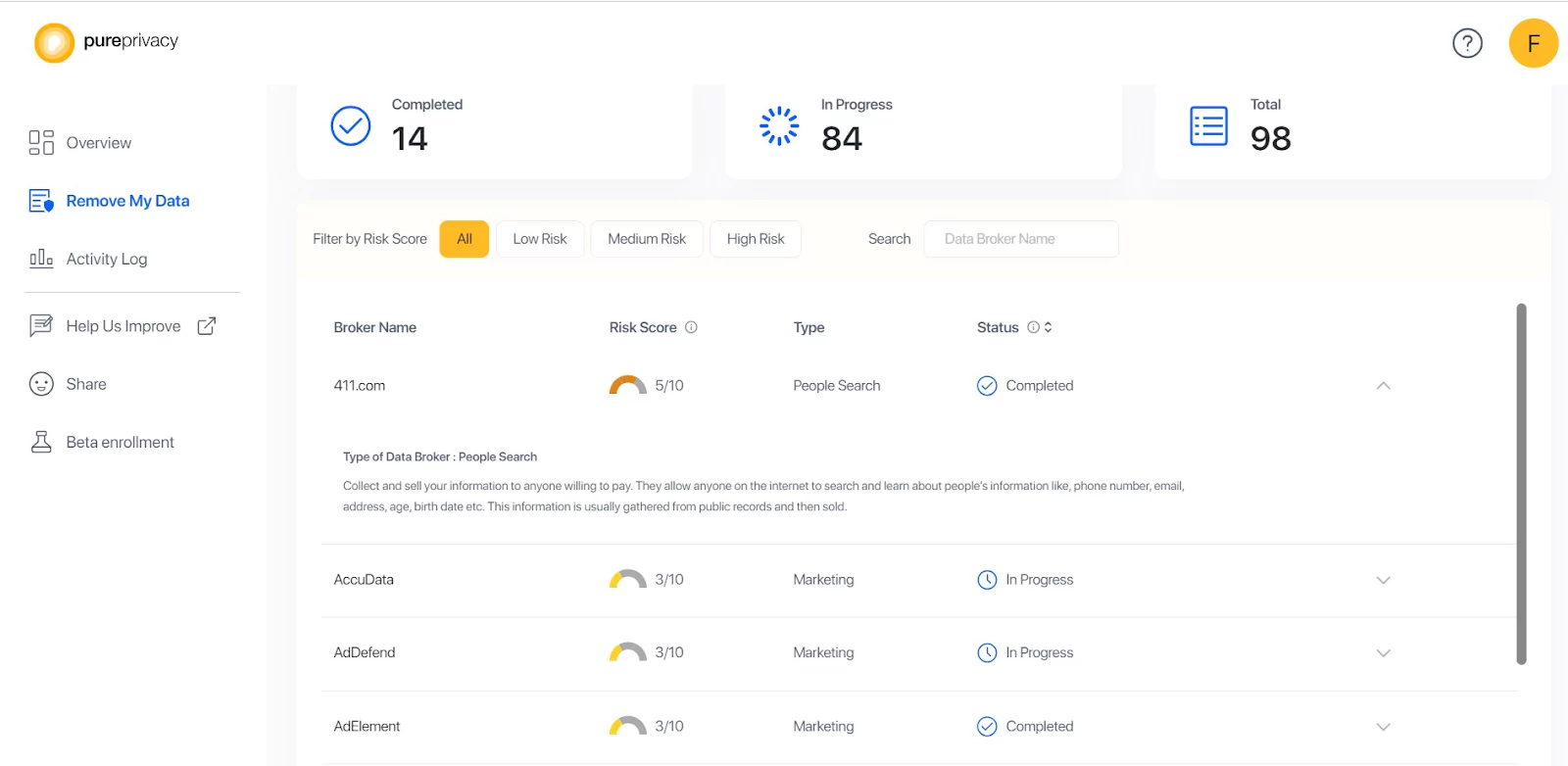

Avoiding companies like 700Credit is a good initial step, but to safeguard your online information, you need PurePrivacy.

It prevents companies from collecting your personal information without your permission and enhances social media privacy.

Remove Your Personal Information Using PurePrivacy

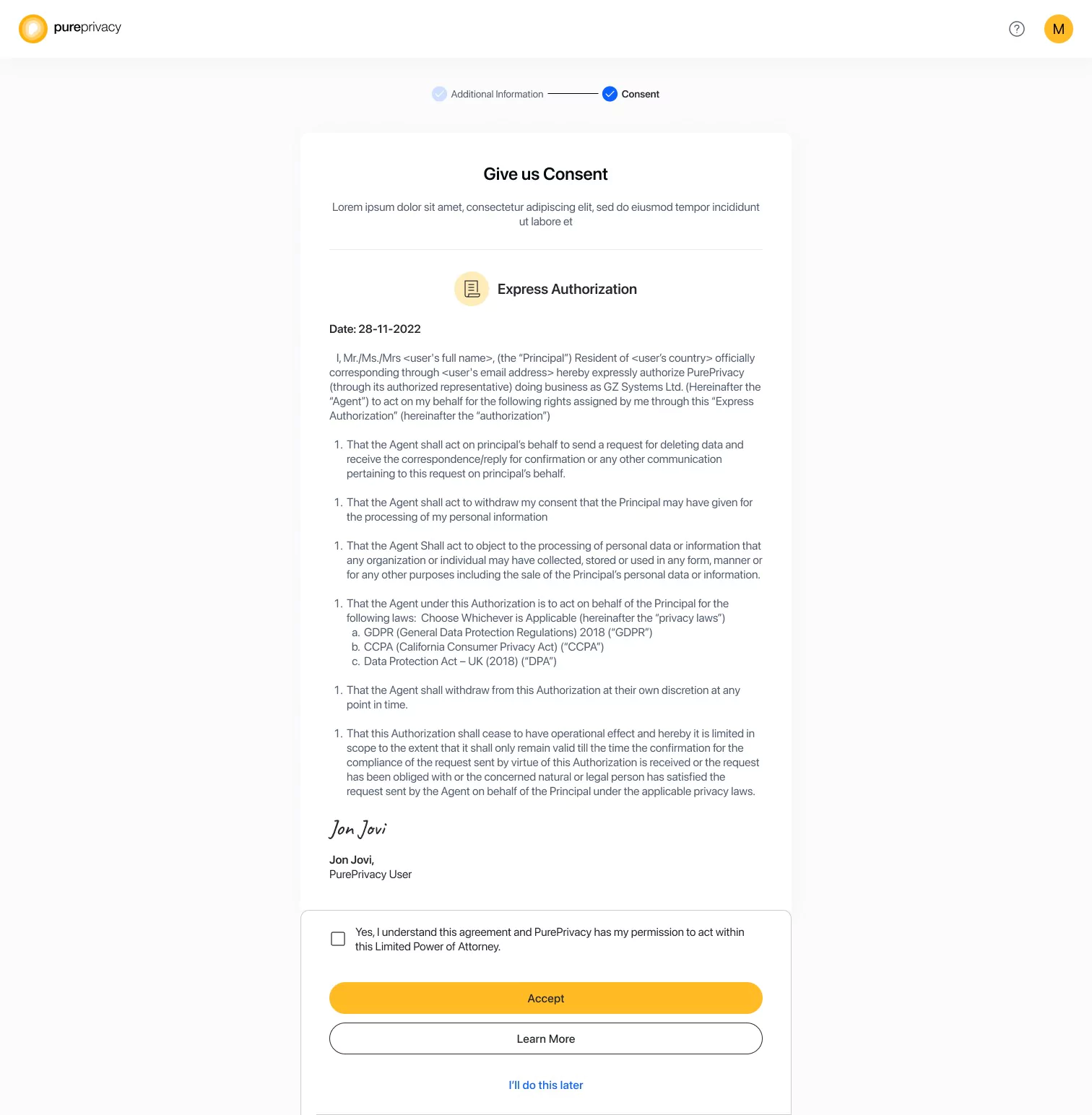

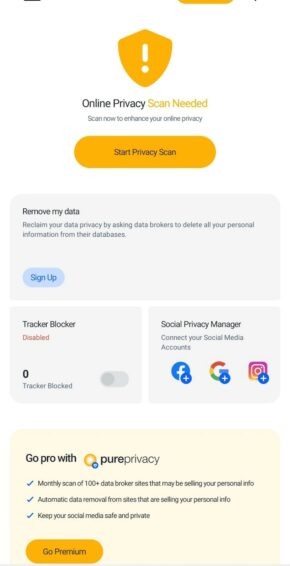

PurePrivacy is an all-in-one application that protects your privacy, and lets you control who sees your information online.

It ensures your data remains private unless you permit it to share it.

Control Over Credit Information

PurePrivacy empowers you to manage when and how your credit information is shared with 700Credit and other similar services.

Enhanced Online Privacy

By opting out, you can keep your financial data private and prevent 700Credit from accessing your credit information for dealership financing.

Protection Against Credit Inquiries

Opting out reduces the number of hard inquiries on your credit report, helping to maintain or improve your credit score.

Opportunity for Financial Planning

Opting out allows you to assess your credit report beforehand and address any issues, ensuring that you're in a better position when applying for loans or financing in the future.

Enjoy Peace of Mind

Knowing that you have control over who accesses your credit information can provide peace of mind and a sense of security regarding your financial privacy.

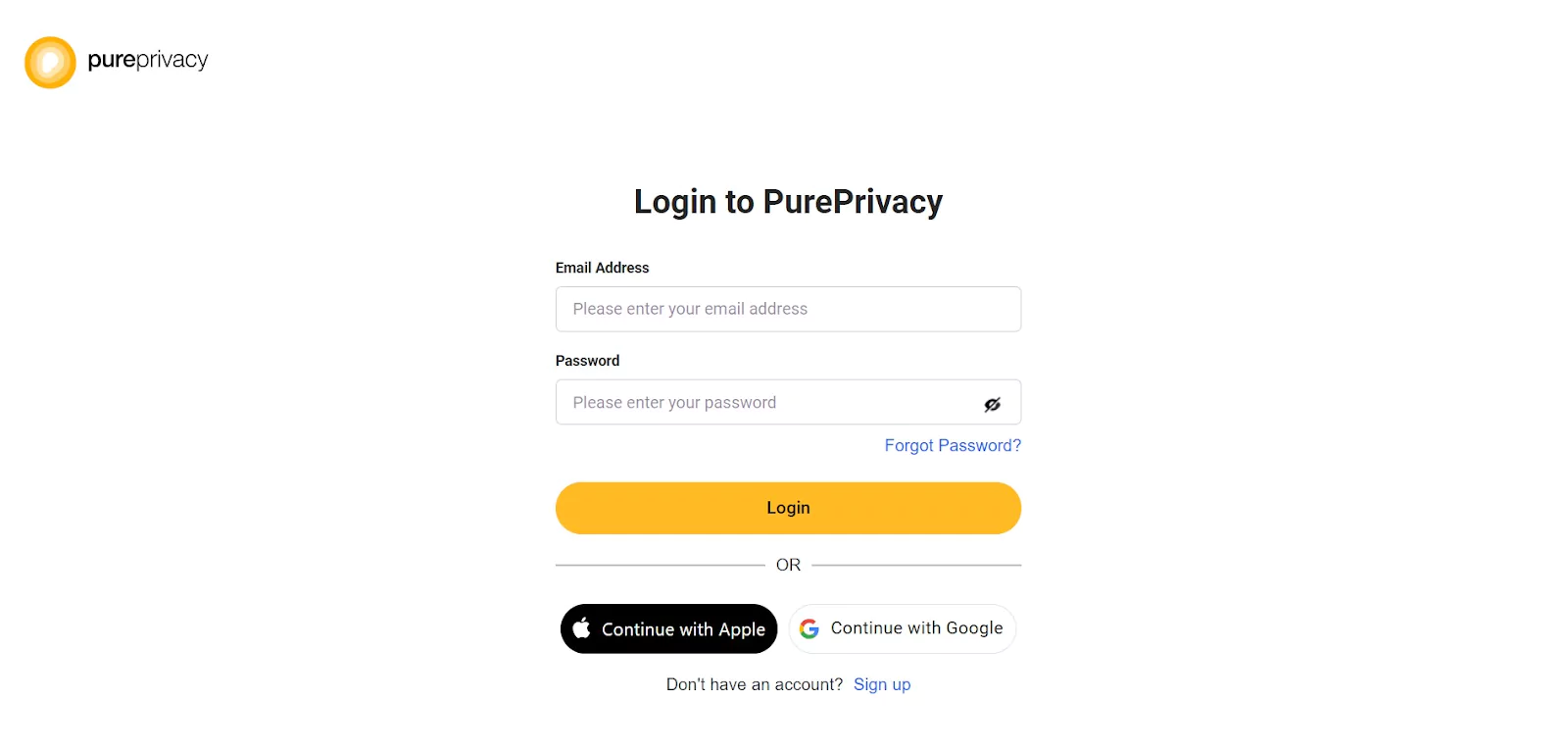

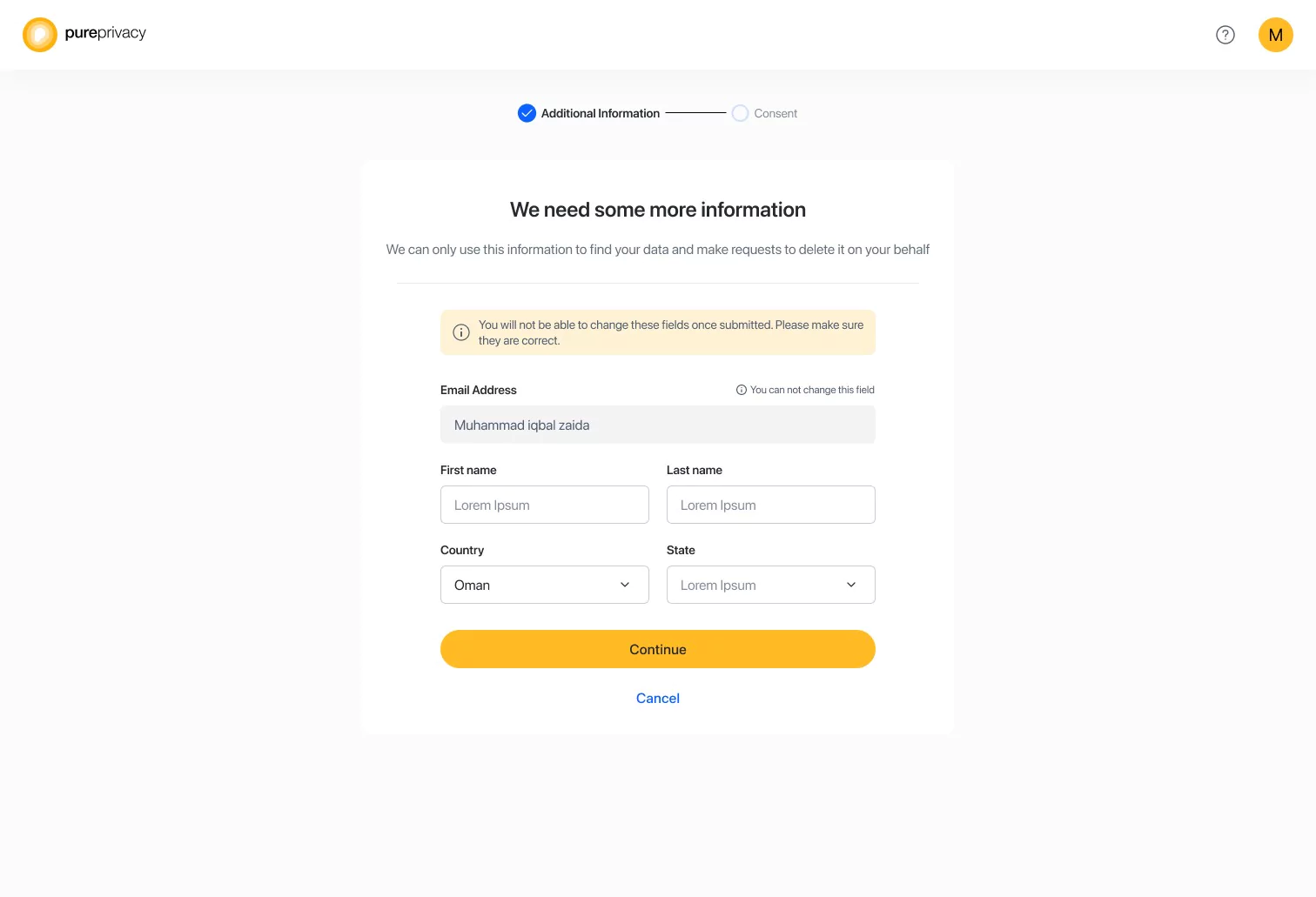

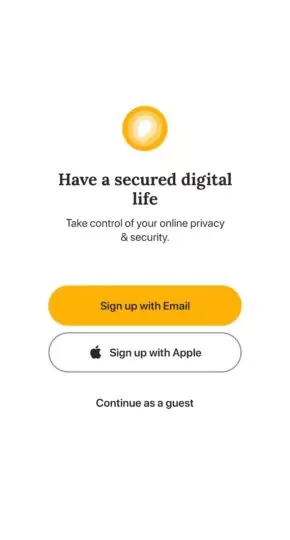

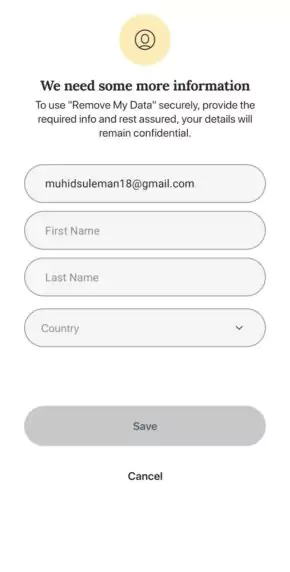

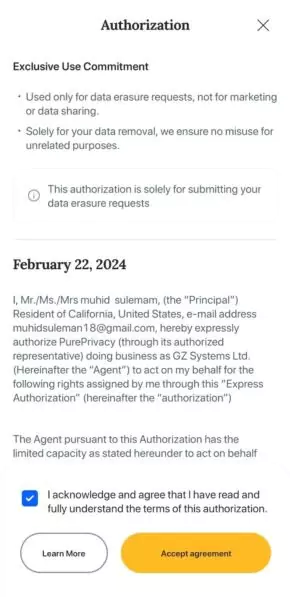

Steps to Opt-Out Using PurePrivacy

Manually Opt-Out Method Vs. Opt-Out With PurePrivacy

- Requires navigating through 700Credit's opt-out process.

- Requires staying informed about the opt-out process and any updates from 700Credit.

- Limited to the opt-out options provided by 700Credit and may not offer additional privacy features.

- Offers an automated opt-out feature, saving you time and effort.

- Offers peace of mind by ensuring consistent and comprehensive opt-out across various platforms.

- Provides additional privacy features beyond basic opt-out functionality.

Frequently Asked Questions (FAQs)

-

How long does it take to opt out of 700Credit?

Opting out of 700Credit can take a few minutes, as you may need to fill out a form or follow their opt-out process. However, the exact duration can vary depending on their procedures and how quickly they process your opt-out requests.

-

Can my data still be visible on 700Credit Opt-Out after successful data Opt-Out?

If you've opted out of 700Credit, your data should no longer be visible there. However, it's a good idea to check occasionally to ensure it stays that way.

-

Does 700Credit sell my data?

700Credit doesn't usually sell your data. They help car dealerships with credit reports and financing but don't share your information for marketing.

Secure Your Data Online!

700Credit could share your data with other companies, but you can choose to opt-out anytime.

PurePrivacy keeps your data secure by only sharing it with those you trust.

Your information won't be shared without your permission!