Table of Content

- What is Experian?

- Why Should I Remove My Old Address from Experian?

- How to Remove Your Old Addresses from Experian

- Important Things to Consider Before Removing Old Address from Experian

- Is Experian Considered a Secure Platform?

- Take Control of Your Privacy with PurePrivacy

- Frequently Asked Questions (FAQs)

- Remove Old Addresses from Experian and Minimise Identity Theft Risks

Keeping a correct credit report is essential. Old addresses can complicate your Experian report and potentially lead to confusion.

If you have recently relocated or have outdated addresses listed, this is how to remove them from your Experian report.

We will help you through the process, explain why it is important, and ensure that your credit report matches your current information.

What is Experian?

Experian is a worldwide data analytics and credit reporting company based in Dublin, Ireland. Experian stores and combines data on over 1 billion people and businesses, including 235 million individual US consumers and over 25 million US companies.

Experian is listed on the London Stock Exchange and is part of the FTSE 100 Index. It is a partner in USPS address verification and is one of the "Big Three" credit reporting companies, along with TransUnion and Equifax.

Why Should I Remove My Old Address from Experian?

While removing an outdated address from Experian will not have an immediate impact on your credit score, there are a few reasons why it can be helpful:

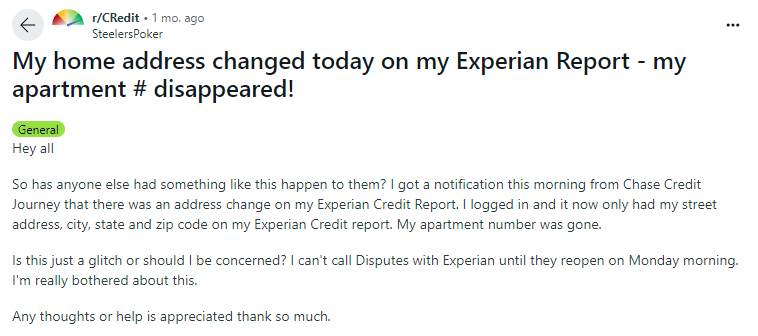

Fraud Prevention

- An unexpected address on your report could indicate identity theft.

- If you do not recognize an address, removing it can assist in preventing fraudulent activity associated with that location.

Accuracy of Information

- Keeping a valid credit report is important. Old data can cause problems during application or verification processes.

- Removing outdated addresses keeps the report clean and up to date.

Security Concerns

- In general, less information is preferable for identity protection.

- Remove unnecessary addresses to reduce the risk of your private data being exposed.

How to Remove Your Old Addresses from Experian

Here is a step-by-step instruction for removing old addresses from your Experian credit report:

- Get your free Experian credit report at annualcreditreport.com. You can request a free report from Experian once a year.

- Go to the Experian Dispute Center at https://www.experian.com/disputes/main.html.

- Click Start a new dispute and then follow the on-screen instructions.

- Select Personal Information and then Address as the category you want to dispute.

- Specify the old address you want to remove.

- After reviewing your information, please submit your dispute digitally.

- Experian will review your claim and respond within 30 days. They will either remove or explain why the address stays.

Important Things to Consider Before Removing Old Address from Experian

Before removing an old address from Experian, here are some key considerations:

Linked Accounts

- If you have any financial accounts (loans, credit cards, etc.) linked to your previous address.

- Removing the address can lead to verification problems in the future if you need to manage those accounts.

- It's better to immediately contact the creditor(s) to update your address before removing it from Experian.

Public Records

- Is the old address listed in public records about your credit history, such as a bankruptcy filing or previous property ownership?

- This information may be associated with your Social Security number, so removing the address from Experian may be difficult.

- In this case, focus on challenging any mistakes in the public record itself.

Joint Accounts and Leases

- If you have an account or lease agreement with someone else at the old address, removing it may cause them difficulties.

- Talk to them beforehand and make sure they update their details with the appropriate persons as needed.

Potential Verification Delays

- Even if you have no associated accounts, deleting an outdated address may delay future credit applications or verifications.

- Lenders can use previous addresses for further identity verification.

Is Experian Considered a Secure Platform?

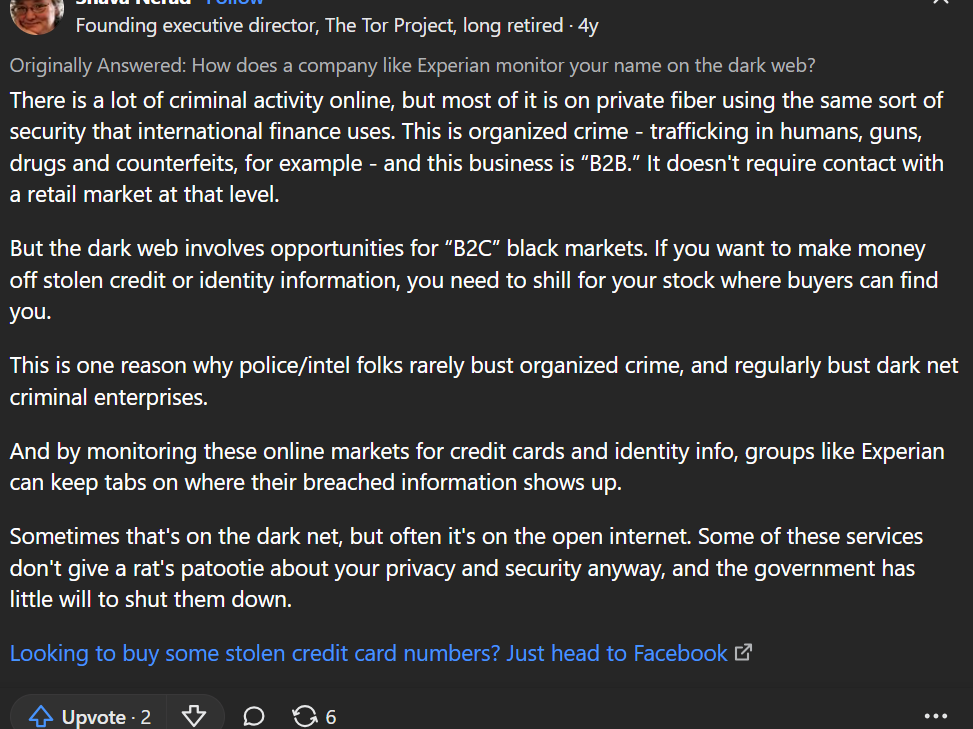

Experian uses a variety of security methods for protecting customer information, including vulnerability scanning and malware detection. However, no system is flawless.

Phishing attacks (fake emails or websites mimicking Experian to steal login credentials) and weaknesses in security that hackers might use to obtain unauthorised access to customer data are two examples of possible security risks.

Following online security standards, such as using strong passwords and avoiding suspicious links, is critical.

Like many companies, Experian encounters security risks such as phishing and hacking. PurePrivacy can help by providing features such as social media privacy assessments and recommendations.

It also helps you remove your information from data brokers, who can offer it to third parties.

Take Control of Your Privacy with PurePrivacy

PurePrivacy works as your privacy manager, assisting you with controlling your social media presence and reducing the amount of personal information exposed through data brokers.

What Features Does PurePrivacy Offer

Tracker Blocker

- This function establishes a device-based VPN when you give your permission.

- The VPN then blocks recognized trackers from communicating with their domains, which helps to keep your internet activity confidential.

Whitelist/Blacklist Trackers

- PurePrivacy allows you to whitelist specific trackers that you consider safe.

- You can also choose to block these trackers again if needed.

Privacy Scan

- PurePrivacy analyses significant risks to your account by assessing pending actions for each feature.

- For example, if you haven't joined any social media accounts or turned on the tracker blocker, the scan will identify these areas as possible risks.

Remove My Data

- This feature allows you to manage data held by data brokers.

- After you give your approval, PurePrivacy makes periodic data removal requests to supported brokers on your behalf.

- You can track the status of these requests using the in-app dashboard and receive weekly reports.

Frequently Asked Questions (FAQs)

-

Can I remove old addresses from my credit report?

Yes, you can delete addresses from your credit report if they are not currently associated with any of your accounts. Typically, you will need to register a dispute with the credit bureaus. Each credit agency (Experian, Equifax, and Transunion) offers means to challenge a charge online or by mail.

-

How can I remove information from Experian?

To remove your name from Experian, Innovis, TransUnion, and Equifax's prescreened credit or insurance offer mailing lists, call 1 888 5OPTOUT (1 888 567 8688). You will be given the option to opt out for five years or permanently.

-

How can I change the address on my Experian account?

You can submit copies of two utility bills, such as an electricity bill and a phone bill, with your name and address, or a utility bill and a bank statement, together with a brief message explaining that you have relocated and would like your new address added to your credit report.

-

How long does it take Experian to delete an account?

If you made late payments on the account, they will appear on your credit report for seven years before being deleted automatically. If the account was late at the time of payment, it will be removed from the report seven years after the initial delinquency date.

Remove Old Addresses from Experian and Minimise Identity Theft Risks

Finally, to ensure a correct report, remove any old Experian addresses. To maintain internet security, consider the associated accounts and public records first.

Get help from PurePrivacy, which enhances privacy by scanning social media and removing data brokers, reducing potential hazards.