Table of Content

In recent months, Chase Bank issued a notice warning customers to be careful of online scammers and fraudsters.

Some cybercriminals are calling Chase customers, pretending to be bank officials, and tricking them to share private information that can put the customer's account at risk of fraud.

Further, Chase warned their customers that they will never call them for payment approvals or refunds. Everything is available on the Chase app.

And even if your bank account highlights suspicious activities, Chase will temporarily block your main account to freeze money.

Protect Your Personal Information from Online Scams With PurePrivacy

With PurePrivacy, you can protect your online presence and control your personal information. Using a cutting-edge and user-friendly interface, PurePrivacy enables you to take proactive measures to maintain your online privacy.

- Use Dark Web Monitoring to search the dark web for your data.

- Use a Tracker Blocker to stop websites and outside trackers from data collection.

- Use Remove My Data to send auto-removal requests to data brokers.

- Use Social Privacy Manager to adjust and tweak your privacy settings.

How Does Chase Collect Your Data?

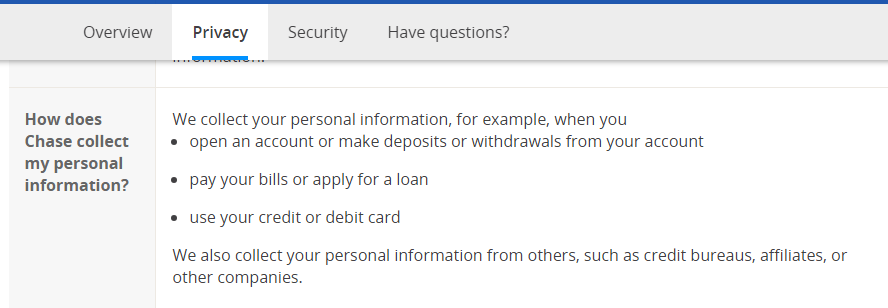

Chase mostly obtains information about you through your use of their services. This includes data you voluntarily submit, like your name, address, and bank account information when you apply for a loan or open an account.

Chase may also obtain information about you indirectly through your internet activity, transaction history, and information gathered from other sources. Using this data, they can identify fraud, tailor their services, and enhance their entire menu of products.

Types of Information Chase Gathers

One of the top financial companies, Chase Bank, gathers different kinds of data from its clients to administer legal requirements and offer customized services.

The following are some of the main types of data that Chase usually collects:

Personal Information

- They gather demographic data, including name, address, birth date, social security number, email address, and phone number.

- Financial data includes income, assets, debts, credit history, and job details.

- Account details include balances, transaction histories, account numbers, and account settings.

Non-Personal Information

- Device details include the operating system, IP address, kind of browser, and device identifiers.

- They also track Usage information, Location data, and Transactional history.

Information from Third-Party Sources

They collect credit reports from other credit bureaus and public records from different public sources and government entities.

Why is it Important to Understand Chase's Privacy Policy?

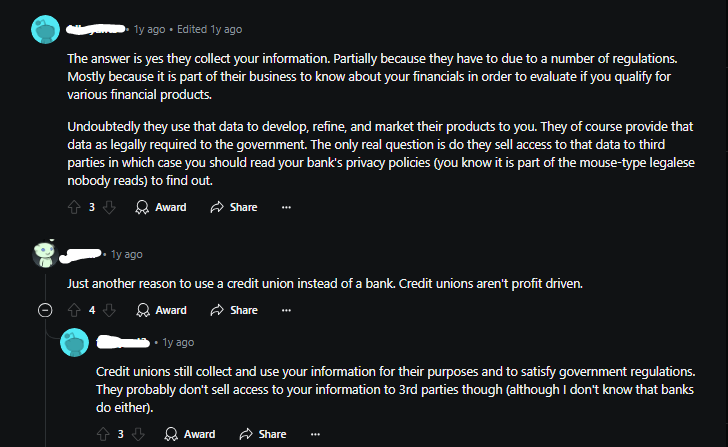

Like many other financial organizations, Chase gathers and utilizes consumer personal data.

It is important to understand their privacy policy for many reasons:

Personal Data Protection

This policy describes how Chase gathers, uses, disseminates, and secures your personal data. Knowing this will help you manage your data appropriately and to your standards.

Knowing Data-Sharing Practices

The policy describes the parties, including affiliates, outside service providers, and law enforcement, with which Chase may share personal information. You can use this information to make well-informed decisions regarding your banking relationship.

Recognizing Your Privacy Rights

The policy should specify your rights as a client, such as the ability to see, amend, or remove your personal data. Being aware of your rights allows you to take charge of your data.

Preventing Identity Theft

A thorough privacy policy should outline Chase's steps to protect your information against unwanted access or disclosure. This will reduce the chance of identity theft and other security lapses.

Compliance with Regulations

Several privacy and data protection regulations apply to financial institutions. By becoming aware of Chase's privacy policy, you can ensure it adheres to relevant requirements.

How to Protect Your Personal Information on Chase?

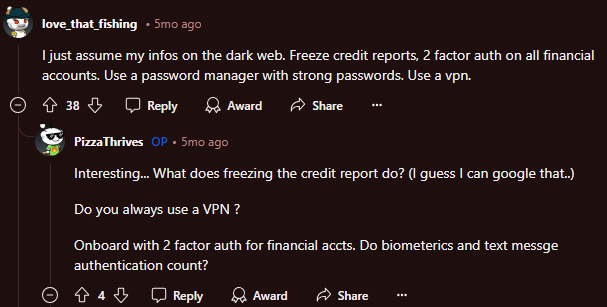

Chase takes security seriously, but you should always take extra precautions to protect sensitive data.

Here are some actions that you can do:

Make Unique, Strong Passwords

Use a blend of capital and lowercase characters, digits, and symbols.

Don't use information that can be guessed, such as pet names or birthdays.

Turn on Two-Factor Authentication

To increase security, turn on Two-Factor Authentication. This requires your password and a code emailed to your phone or email.

Set Up Account Alerts

Get informed when something strange happens with your account, such as a password change. Review the contact details we have on file to ensure they are accurate.

Use the Latest Browser

Update your operating system, apps, and web browsers to the most recent version to help shield you and your devices against security flaws that cybercriminals could exploit.

When it comes to protecting personal information, using the same old techniques won’t work anymore when you know hackers and scammers are ten steps ahead of you.

If you are in research mode or looking to get an all-in-one privacy app, consider PurePrivacy. It offers dark web monitoring scans with other data privacy features that can help you get added privacy.

Monitor the Dark Web

Get notified whenever someone posts your data on the dark web and take quick action to reduce the damage.

Stay Safe from Intrusive Ads

Block unwanted, invisible cookies to enhance online privacy, reduce ad traffic, and enjoy your surfing experience.

Remove Your Data from Data Brokers

Delete your personal information from data broker websites and reduce the risk of identity theft and data leaks.

Manage the Social Privacy Settings

Manage the audience for your posts, comments, and other private content. Control how much personal information social media firms can gather about you.

Frequently Asked Questions (FAQs)

-

How can my Chase account be secured?

Use the password manager or the biometric setting on your phone. Our app supports Apple TouchID, FaceID, Android fingerprint, or face recognition login for fast and secure account access, and the chase.com website has password management enabled.

-

Does Chase offer protection for my identity?

Chase Credit Journey provides free identity monitoring and dark web monitoring. When you enroll, we'll let you know if we find your information on dubious websites or any behavior associated with your identity.

-

How can I stop giving Chase access to my data?

In certain situations, you have the right to request that we not disclose your personal information. You have options on how we share your personal information, which are outlined in the U.S. Consumer Privacy Notice. You can reach us by phone at 1-888-868-8618, our Privacy Call Center.

-

What kind of encryption does Chase use?

The Secure Socket Layer (SSL) technology with 128-bit encryption is what we use to protect your account information, passwords, and usernames. We will decrypt any encrypted information you receive using the Chase Mobile® app.

Wrapping Up!

Cybersecurity risks and identity theft are on the rise these days. To protect your data and prevent unwanted access, use PurePrivacy paired with a VPN.