Your credit card number is crucial to your financial security. Once leaked in a data breach, it makes you vulnerable to identity theft, reputational harm, and drained bank accounts. Plus, if your data is sold on the dark web, the damage could be irreparable.

4 Immediate Steps to Take if Your Credit Card Is Exposed in a Breach

Once you discover your credit card number has been leaked, you must act quickly to avoid financial loss.

- Contact Your Credit Card Issuer Immediately

Get a new credit card and request that your old card be immediately canceled. Also, make sure that it was not used fraudulently by contacting your credit card provider.

- Review Your Recent Transactions

Track where your card was recently used without your authorization. Check the date, location, and transaction amounts for any unauthorized purchases.

- Change Your Passwords

Change your password if the card was accessed through an online account. Remember to keep unguessable passwords.

- Check Your Credit Report and Fraud Alert

Review your credit reports, activate fraud alerts, and freeze your credit to reduce the risk of identity theft.

What Happens if My Credit Card Information Gets Leaked?

The immediate threat is unauthorized purchases, with cybercriminals potentially exploiting your card details for both online and in-person transactions.

Plus, your card could be used to subscribe to services or memberships, resulting in recurring charges. Without any security measures, your compromised data could be sold on the dark web, compounding the financial risk.

How to Minimize Damage During Data Breaches

If your information is a part of any data breach, beware – scammers, intruders, and hackers may exploit it for their gain.

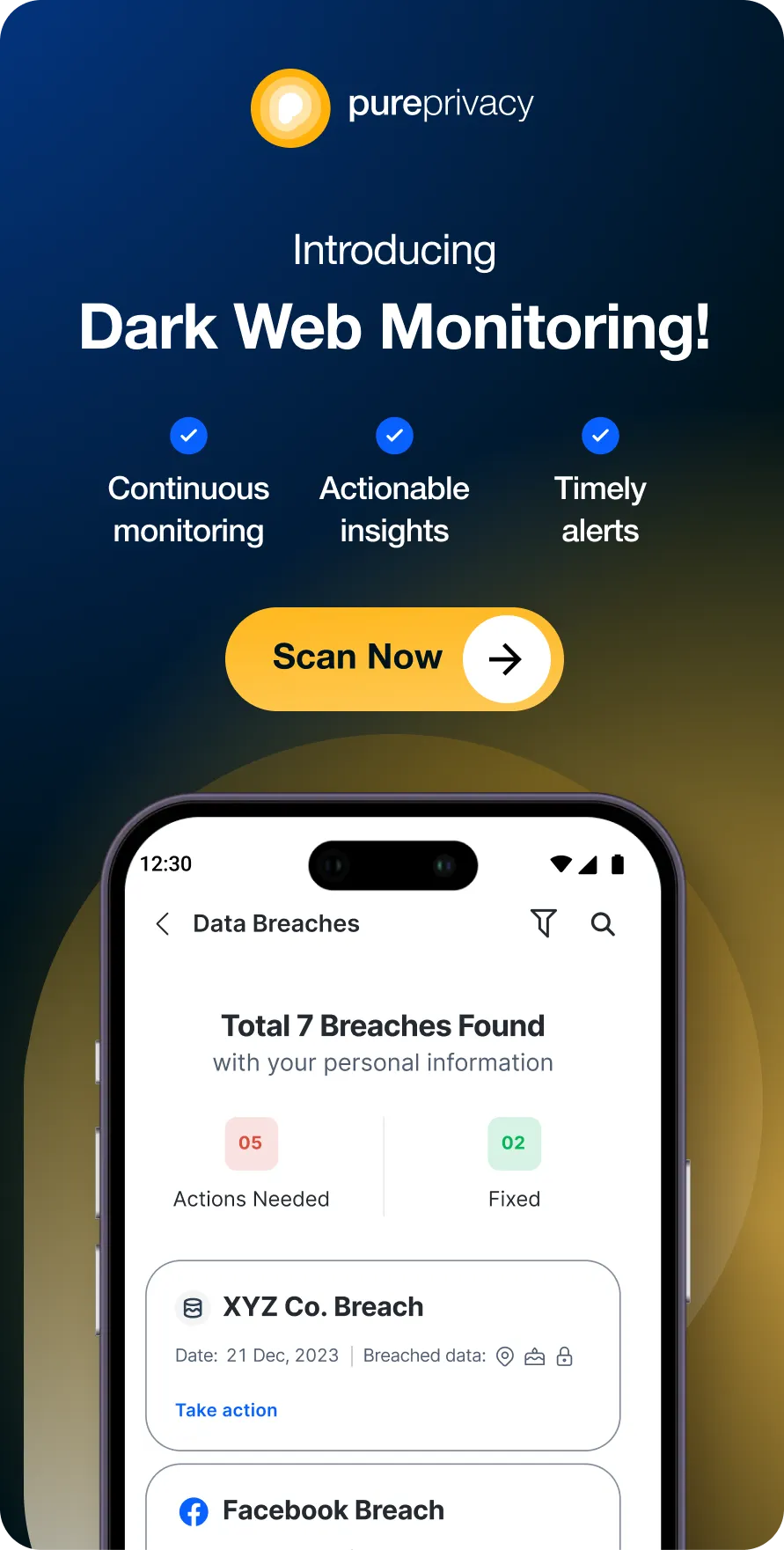

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Your data is at great risk of being sold on the dark web, where it cannot be removed and can be misused by criminals in various ways.

PureVPN’s Dark Web Monitoring helps track your most critical digital identifiers that might have ended up on the dark web so you can take the necessary precautions before your sensitive data is exploited.

How to Enable Dark Web Monitoring on PureVPN

- Install PureVPN on your device or update your existing VPN app.

- Visit the Members Area to get access.

- Go to Dark Web Monitoring from the main menu.

- Add your email address, phone number, credit card number, passport number, and Social Security or National Identity number.

- Add the one-time code sent to your registered number in the relevant field.

6. Review beach details and take the recommended steps if your data is part of a breach.

8. Mark the breach as resolved once done.

Frequently Asked Questions (FAQs)

-

How do I know if my credit card number is being used for fraud?

There are some signs to identify if your credit card is being used for fraud.

Check your statement for charges you don't recognize.

Look for any updates or changes in your account details

Review new account inquiries on your credit report

Keep an eye out for fraud alerts sent through your bank. -

How much does PureVPN's dark web scan cost?

You can get a free scan on PureVPN’s website to check if your email has been compromised and appears on dark marketplaces. To get timely alerts and actionable steps to prevent data exploitation, get Max Plan @ $7.07/month.

-

My credit card got hacked. What do I need to do?

Report the fraudulent activity to your credit card provider. Also, request them to cancel your card and issue a new one. Carefully examine your online statements for any unauthorized purchases, even small ones, and keep a close eye on your credit reports for any suspicious activity.

-

My credit card info was stolen, and I'm trying to figure out how.

Your credit card details may have been stolen through a data breach, phishing scam, ATM skimming, unsecured payments, or malware. Check your recent transactions and security settings to spot any risks.

Wrap Up

Your financial data is an asset for cybercriminals. Once they get their hands on it, your reputation could be damaged and even lead to financial loss. It is time to take control of your data and track its exposure with PureVPN’s Dark Web Monitoring.