Your credit card provides convenience, but it also carries the risk of misuse. Seeing unauthorized charges can be a stressful experience. You can identify if your credit card number has been compromised and is being used by someone else by noticing some simple signs. Keeping your credit card data is essential as it might incur heavy financial loss to you.

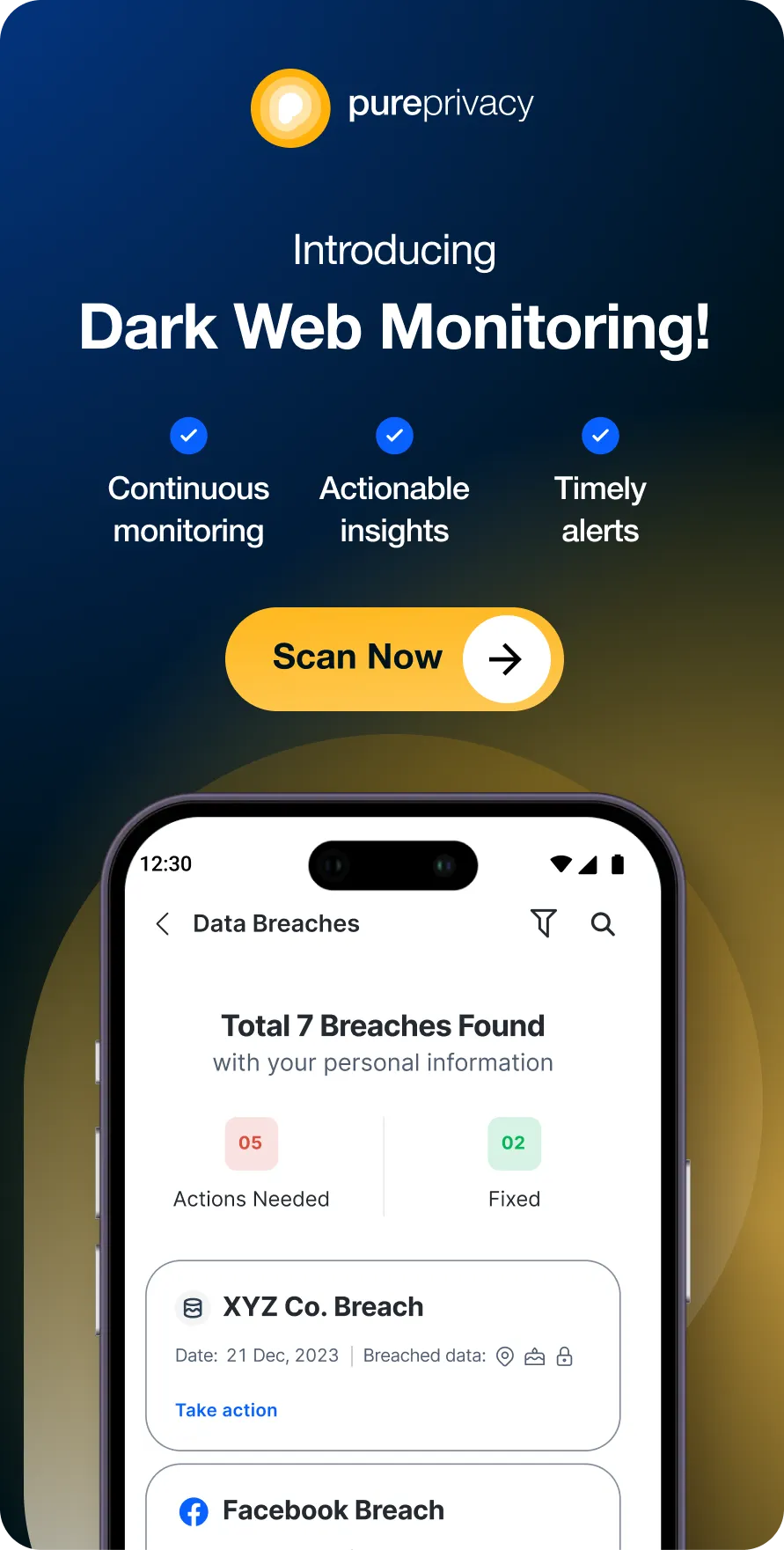

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Signs to Know if Someone is Using Your Credit Card Number

You can guess if your Credit Card Number is used by someone without your knowledge by looking for these signs:

- Unexpected Transactions

This is the most obvious sign. Review your online statements or monthly bills carefully for purchases you don't recognize, no matter how small. If you see transactions from stores or websites you have never used or in cities or countries you have not visited, be suspicious. Plus, if you see several declined transactions followed by a successful one, that is a red flag.

- Account Issues

If your available credit limit is surprisingly low, it could be due to unauthorized charges. If your regular statements stop arriving, a fraudster might have changed your address to prevent you from noticing fraudulent activity. Unexpected emails or calls verifying purchases you did not make might mean a phishing attempt.

- Other Warning Signs

Receiving a credit card you did not apply for could mean someone has your personal information and is opening accounts in your name.

An increase in spam emails or calls might mean your details have been sold to other scammers. Plus, if a company you have shopped with announces a data breach, your card information could be at risk.

What To Do If Someone Is Using Your Credit Card Number?

It is important to take immediate action if you suspect that someone is using your Credit Card Number. You must immediately:

- Contact Your Credit Card Company

Report the unauthorized charges and request to cancel your current card and get a new credit card with a different number. Inquire about their fraud protection policies and liability for unauthorized charges.

- Review Recent Transactions Carefully

Go through your online statements or recent bills and identify all fraudulent charges, even small ones. Provide the credit card company with specific details of the unauthorized transactions.

- Change Your Online Banking and Related Account Passwords

Update passwords for your online credit card account and change passwords for any other financial accounts that might be linked or accessible.

- Consider Placing a Fraud Alert on Your Credit Report

Contact one of the three major credit bureaus (Equifax, Experian, TransUnion). A fraud alert requires creditors to take extra steps to verify your identity before opening new accounts.

- File a Police Report

Report the incident to your local police department. Obtain a copy of the police report for your records and provide it to the credit card company if requested.

Interesting read : Bidencash Credit Card Leak

What Can Happen If Someone Uses Your Credit Card Number?

If someone uses your credit card number without your authorization, multiple negative consequences can occur:

- Financial Harm

The most direct impact is financial loss from the purchases you didn’t make. If your credit card is linked to your bank account, scammers might attempt to access those funds as well. Suppose the fraudulent activity leads to a negative credit history. In that case, it can damage your credit score, making it harder to get loans or mortgages or even rent an apartment in the future.

- Damage to Your Credit Score

Unauthorized charges can increase your credit utilization ratio. If fraudulent charges go unnoticed and unpaid, they can lead to late payment marks or even defaults on your credit report, severely damaging your score.

- Distribution of Your Credit Card Data

If a scammer has your credit card data, they would sell it to various people who can use it for identity theft multiple times. This could harm your reputation and could be damaging if your data is on the dark web.

Protect and Prevent Your Data from Exploitation

If your private data, including your Credit Card Number, social accounts, passwords, and more, is used without your knowledge, there is a chance that it might be rotating on the dark web too.

Besides being vigilant, you need a holistic solution for your privacy protection. With PurePrivacy, you can manage your data easily.

- Get a real-time privacy score about how vulnerable your data is.

- Manage your social media privacy with customised recommendations.

- Enable tracker blocker to avoid unnecessary tracking.

- Delete your essential data from data brokers to limit unwanted advertisements.

Enable Dark Web Monitoring on PurePrivacy

You must protect your data from ending up on the dark web. Here’s what to do:

- Sign up for PureMax.

- Download and install the PurePrivacy app.

- Log in to your account and select Dark Web Monitoring.

- Select Add Assets to Monitor and add your Credit Card Number, Credit Card Number/NIN, credit card number, passport number, and phone number.

- Enter the code sent to your registered number, and you’re done.

- Follow the recommended measures if your data is part of a breach to prevent further misuse.

Frequently Asked Questions (FAQs)

-

How do you know if someone used your Credit Card Number?

Your Credit Card Number might be used by someone if you have noticed unfamiliar transactions, purchases made at places you have never visited. Take prompt actions to prevent financial loss.

-

Can someone use your Credit Card Number?

Yes, your Credit Card Number could be used for various illegitimate uses if leaked. An intruder could sell your data on the dark web, your credit card could be used for various malicious intentions or your bank accounts could be drained.

-

How to get notified if someone uses your Credit Card Number?

You can track if your credit card is being used fraudulently by someone if you receive calls and emails about the confirmation of purchases you did not make, receive bank notifications about the huge transactions, or attempts to withdraw money from places you do not recognise.

-

How can I stop someone from using my Credit Card Number?

Keep your card secure and avoid sharing your Credit Card Number unnecessarily, especially on unsafe websites. Be vigilant about monitoring your credit reports and financial accounts for any suspicious activity.

Wrap Up

If your credit card is used by someone else, you are at great financial risk. Try to watch out for signs of unauthorised use and prevent further damage by monitoring your personal information with PureVPN dark web monitor so that you don’t end up with your data being exploited.