The Acorns app is a micro-investing software that allows you to expand your money as time passes.

However, canceling your Acorns account is an easy procedure if one wants to switch to a different platform or just wishes to have some time off from spending.

You can close your Acorns account following this blog, which also explains how to withdraw the money that is left and how to keep your information safe with PurePrivacy.

What Is Acorns?

Acorns was launched in the US in 2012 as a smartphone application designed to make investments and savings easier for everyone, starting with the inspiring step of micro-investment.

Serving more than 4.5 million average Americans, Acorns is an innovator in US financial services by empowering people with the means to generate money.

Rewards investment from companies while they shop, effortless investments in different portfolios, a basic retirement product, and a simple method to make investments for their children are all provided to customers.

Acorns Digital Security And Privacy Of Data

Although Acorns protects data from websites and apps to try to keep you secure, a lot of personal details are still gathered and shared by the program.

The information that is gathered, including your name, Social Security number, and bank account information, has been made clear in the privacy policy. It also outlines whether the information is shared and whether you can ask for it to remain private.

How to Delete Acorns Account

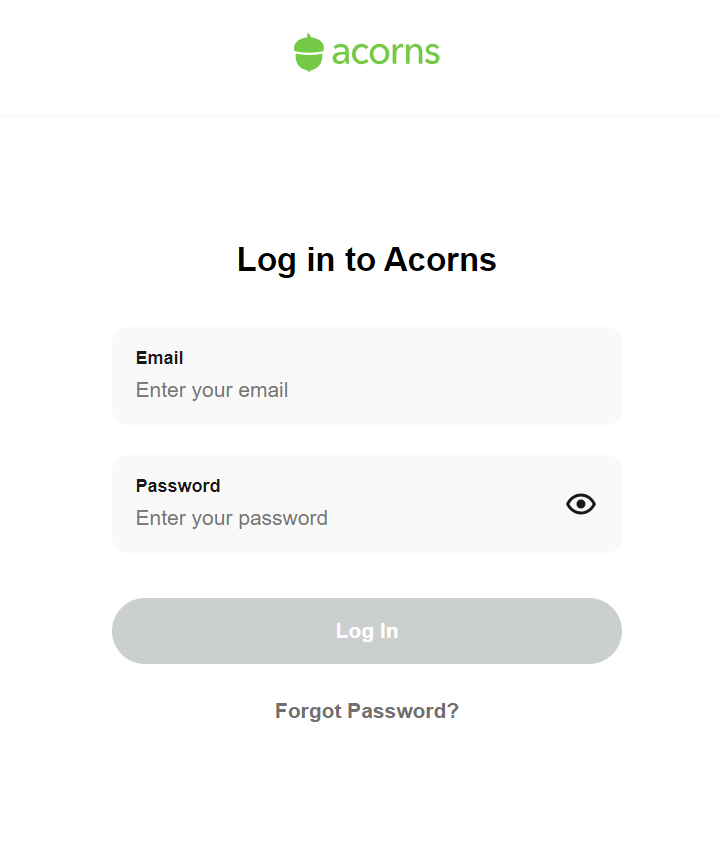

- Open your web browser and navigate to app.acorn. You can delete your account on an Android device or a PC by visiting Acorns through a web browser.

- Access your account by logging in. Enter your email address and password, then click the login button if you are not already signed in.

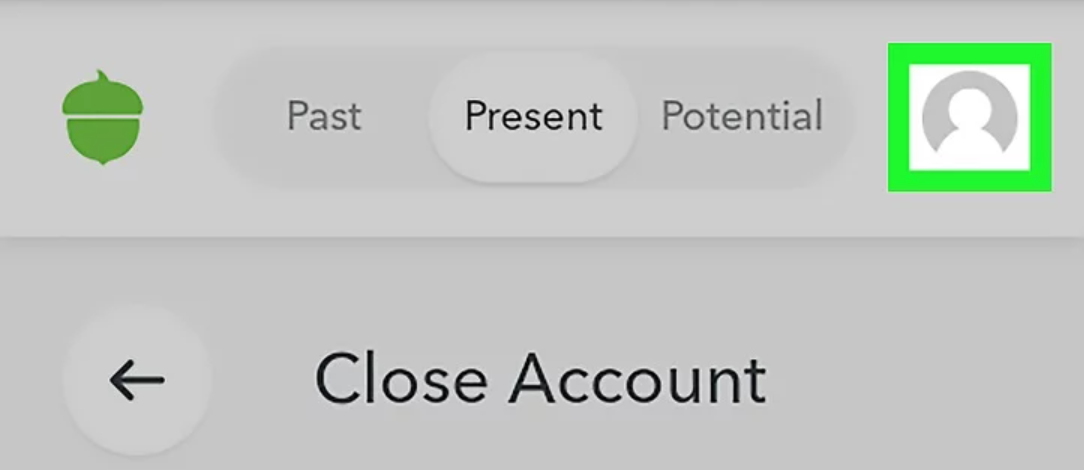

- On the top-right, click your profile picture to see your profile, and launch the menu.

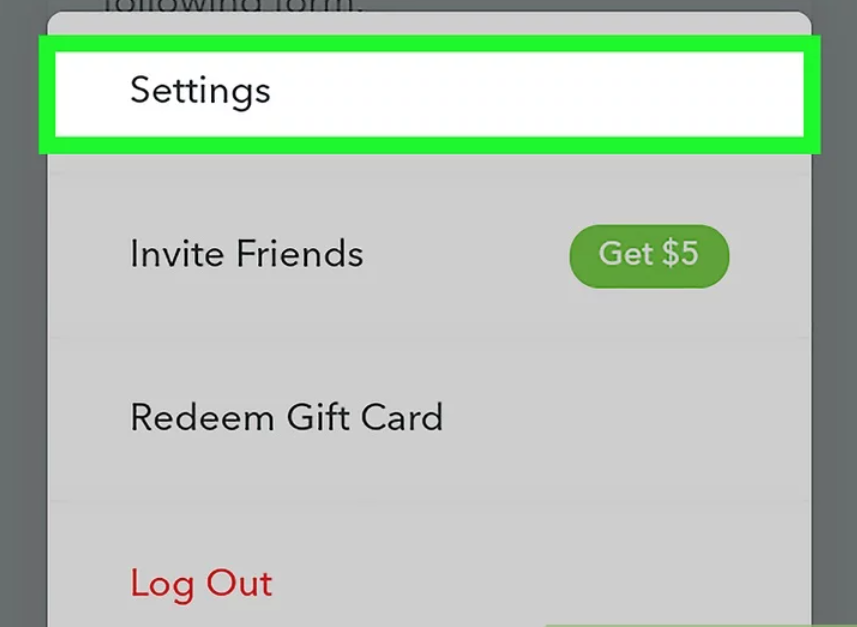

- Select Settings. It is located at the top of the menu.

- Select the "Subscription" link found under the "Personal" or "Personal Settings" section.

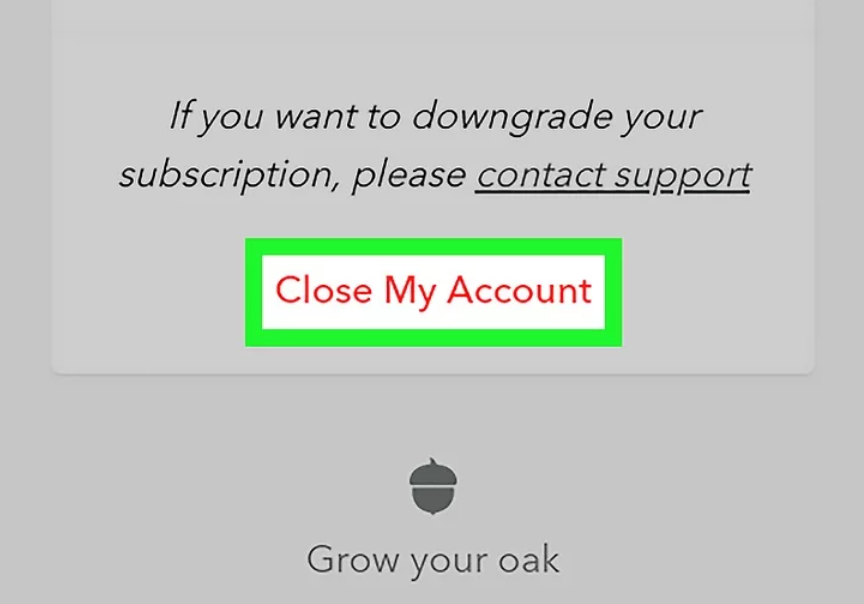

- Select the "Close My Account" link in red. Click this link in the lower-right corner of the screen if you have a standard (Core) account without any upgrades. You will receive a confirmation message.

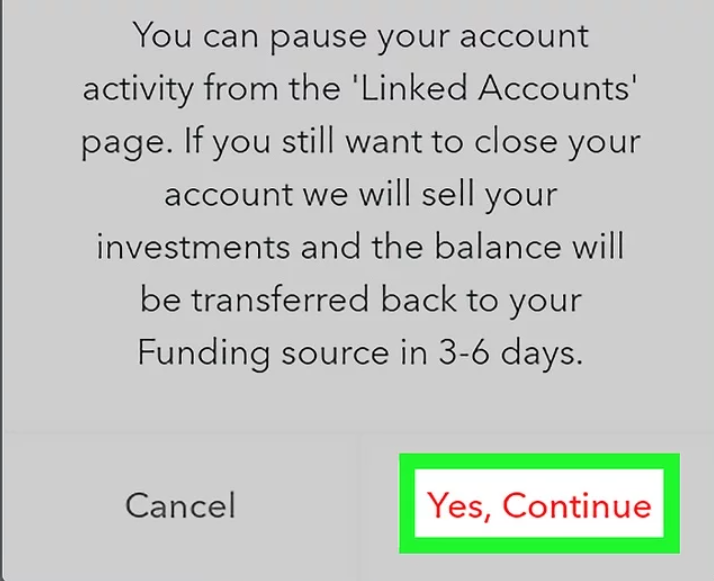

- To delete your account, click "Yes, Continue". To complete the cancellation, you might need to verify your bank account details or payment details, based on the present balance and status of your account.

Once you cancel the account, the money that was in your account will be transferred back to your initial funding source within three to six business days.

Does Acorns Disclose Any Personal Information?

Yes, sharing your information is necessary for running company operations with Acorns' products and offerings. It is also provided to Acorns affiliates for many reasons. Among them are marketing, offering products and services, and other legal purposes.

To make up for part of their monthly expenses, the majority of low-cost providers exchange your information for marketing. It's a cost in exchange for the lower operating expenses. If you live in California or Vermont, legal regulations restrict your personal information from being shared.

Is Acorns Legit?

Yes. Acorns Advisers is a certified investing firm with the US Securities and Exchange Commission (SEC).

In addition to providing trading services, Acorns Securities is a member of the Financial Industry Regulatory Authority (FINRA) and is registered with the SEC. Furthermore, the assets in your account are protected up to $500,000 if you are a member of the Assets Investor Protection Corporation (SIPC).

Improve Your Safety with PurePrivacy

PurePrivacy is an effective tool for increasing your online security by protecting your passwords and important information.

It simplifies access by putting data security and privacy first by providing users with a secure place to keep and oversee their login credentials across multiple websites and applications.

How Does it Work?

Account Analysis

- Your social media accounts are thoroughly scanned by PurePrivacy to find any security gaps and privacy concerns.

- The research includes limitations on access, sharing information permissions, and profile exposure settings.

Personalized Security Levels

- Customers are free to select the level of protection that best suits their needs, privacy concerns, and personal interests.

- PurePrivacy provides specific guidance to strengthen account security by customizing its recommendations.

One-Tap Suggestions

- Because of PurePrivacy's simple-to-use interface, putting specified security measures into practice is simple.

- With just one swipe, users may instantly implement recommended adjustments to their social media accounts, simplifying the process of improving privacy settings and lowering the possibility of unapproved data exposure.

Security Features

Improved Privacy Settings

- With PurePrivacy, users may strengthen their social media privacy by detecting and fixing possible weaknesses in the setups of their accounts.

- Users can lessen the chance of unwanted access to private data by effectively changing settings and permissions.

Fast Notifications and Updates

- Through PurePrivacy's frequent updates and notifications, stay up to date on the most recent privacy features and settings on social media networks.

- This guarantees that users can quickly put suggested security measures into practice to protect their online presence and stay informed about new dangers.

Simplified Security Operations

- Handling social media privacy is made simple with PurePrivacy, which removes the uncertainty involved in figuring out complicated privacy settings on many sites.

- PurePrivacy reduces the effort of keeping strong privacy protections on a variety of social networking platforms.

Frequently Asked Questions (FAQs)

-

What consequences will I face if I close my Acorns account?

If you decide to close your account, the account will be disabled and the remaining money will be removed. 5. It's vital to remember that although Acorns does not charge fees for withdrawals, there can be tax repercussions based on the kind of account you have and the profits you've made.

-

Is Acorns a helpful app?

New investors or anyone starting with small investments will find Acorns a very beneficial program. You can start making investments with just $5, permitting you to create a portfolio of ETFs based on your investment objectives and risk tolerance.

-

What are the drawbacks of Acorns?

There is no tax loss harvesting.

There are no personal financial advisors.

Low account balances may incur expensive fees. -

Are Acorns available to US nationals only?

Only citizens of the United States or other authorized individuals presently residing in the country may access Acorns. To create an Acorns account, you have to be 18 years old or older. Diversification and asset allocation cannot ensure a return or remove the possibility of loss of principal.

Delete Your Account & Enhance Your Privacy

In a nutshell, using their website to delete your Acorns account is a straightforward procedure. Acorns is a reputable and convenient investing program, but it may not be the best choice for everyone, particularly those who are looking for rapid returns.

Keep in mind that removing your account may result in the loss of any remaining money, so be certain to take responsibility for any possible tax consequences.

Managing your login information among multiple platforms with a service like PurePrivacy is a good option if you are worried about your online safety after canceling your account.