Dark web marketplaces play a central role in distributing stolen personal and financial data. One such marketplace, BidenCash, is a major player, having leaked over 2 million payment card records in multiple data dumps since 2022.

These incidents, which were part of a deliberate campaign to promote the underground site, have escalated concerns about credit card fraud, identity theft, and long-term financial risk for consumers around the world.

Let’s break down what happened, what was exposed, and what actions you should consider.

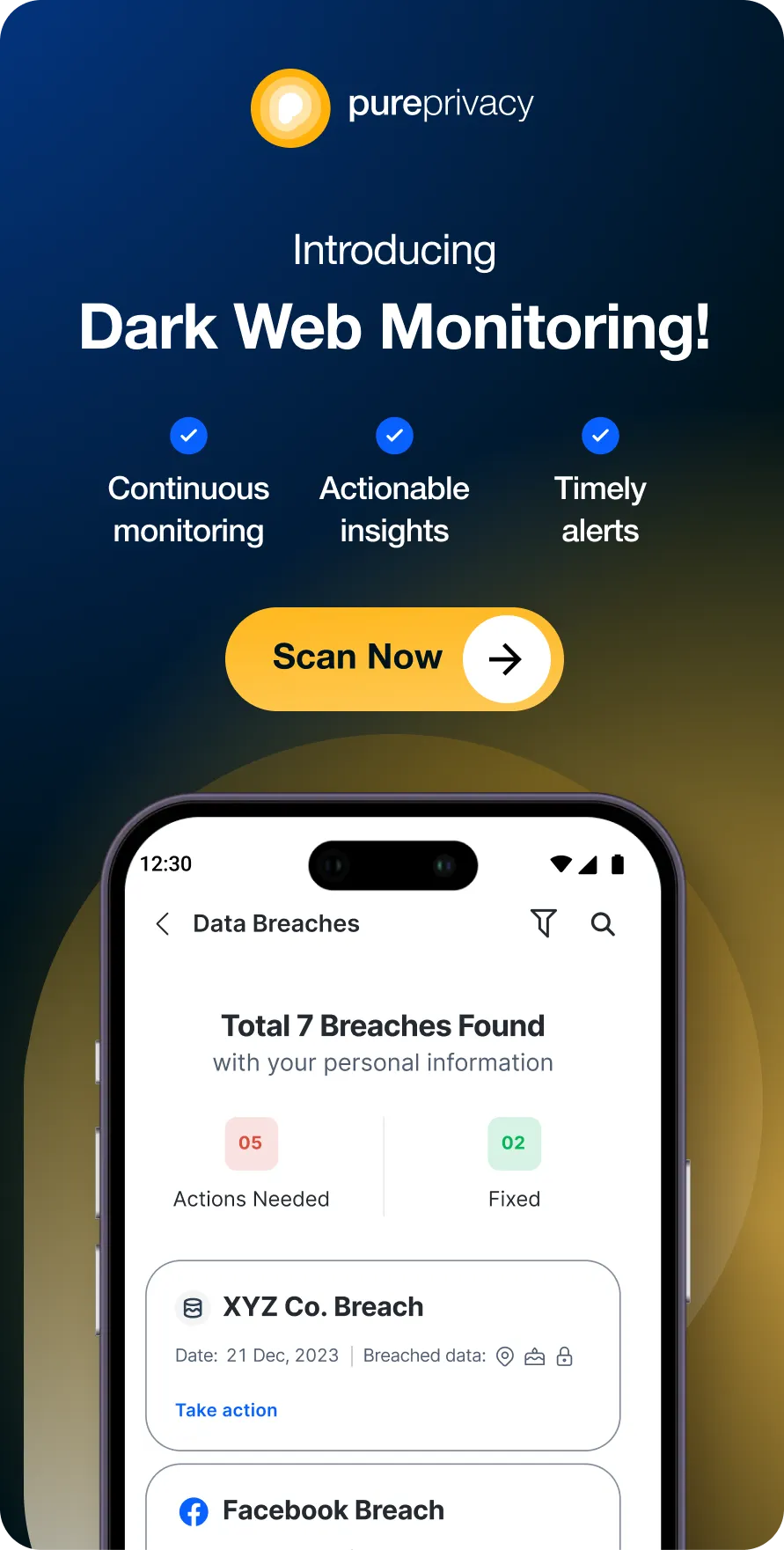

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

What Happened in the BidenCash Data Breaches?

BidenCash has a history of conducting multiple large-scale leaks of stolen credit and debit card data through underground cybercrime forums, mostly on the Russian-speaking forum XSS.

The most recent leak, published on April 14, 2025, included 910,380 credit card records, exposed as part of a campaign to demonstrate the platform's “anti-public system,” which claims to prevent reselling previously distributed cards.

These breaches follow earlier BidenCash releases:

- October 2022: Over 1.2 million card records leaked.

- March 2023: Over 2 million payment card records exposed.

- December 2023: Another 1.6 million plaintext card numbers published.

Key Points

- The most recent leak contained over 900K credit cards.

- Data was aggregated from cybercrime forums and Telegram channels.

- The 2023 leaks alone exposed more than 4 million records.

- Much of the data includes full card numbers, CVV codes, expiration dates, and PII.

Experts from firms such as Cyble and Flashpoint confirm that the leaks include:

- Credit and debit card numbers

- Cardholder names, emails, addresses, and phone numbers

- Associated bank names

What Data Was Exposed?

The datasets released by BidenCash include:

- Full credit and debit card numbers

- CVV security codes

- Expiration dates (some reaching into 2052)

- Personal information like names, phone numbers, email addresses, and physical addresses

While some of the cards are expired, experts warn that this data can still be highly dangerous. Expired cards are often used in targeted phishing, identity theft, and social engineering attacks.

What Are the Risks of This Breach?

BidenCash’s repeated leaks have put millions of individuals at long-term risk, such as:

1. Financial Fraud

With full card details and personal identifiers, cybercriminals can perform unauthorized transactions, open fraudulent accounts, or apply for financial services under your name.

2. Phishing & Identity Theft

Stolen PII allows threat actors to design convincing phishing schemes or commit identity fraud, especially when paired with other breached data.

3. Persistent Dark Web Circulation

Even expired data can be reused, resold, and repackaged, meaning your information might still be circulating years after the original breach.

What Should You Do If Your Data Was Compromised?

If you suspect your data may have been involved in one of these leaks, especially if you’ve used your payment card on online platforms, take the following actions:

Monitor Your Financial Accounts

Review statements regularly. Report unauthorized transactions immediately.

Enable Two-Factor Authentication

Use MFA wherever possible, especially for banking, email, and e-commerce platforms.

Request a Fraud Alert or Credit Freeze

Notify credit bureaus to place a fraud alert or freeze your credit to prevent new account openings in your name.

Use a Dark Web Monitoring Tool

Consider tools like PurePrivacy Dark Web Monitoring to check whether your card or PII is being traded online.

Here's how you can use Dark Web Monitoring:

- Sign up for PureMax.

- Download and install the PurePrivacy app.

- Log in to your account and click Dark Web Monitoring.

- Select Add Assets to Monitor and enter your email address, SSN/NIN, credit card number, passport number, and phone number in the respective fields.

- Enter the code sent to your registered number to verify your identity, and you’re done.

- Follow the recommended measures if your personal data is part of a breach to protect yourself from further harm.

How to Minimize Damage After a Breach

The longer stolen data is in circulation, the higher the chances it’s been misused. Here’s how you can mitigate the fallout:

- Change Passwords Immediately: Avoid reusing credentials across sites. Use a password manager for strong, unique logins.

- Watch for Scam Emails and Calls: Stay alert about unexpected requests for personal information.

- Educate Yourself About Social Engineering Tactics: Understand the tricks attackers use to manipulate individuals using leaked data.

- Push for Corporate Accountability: Demand that companies maintain transparency and strengthen their data protection measures.

Frequently Asked Questions (FAQs)

-

Was BidenCash a ransomware attack?

No, the BidenCash leaks seem to be deliberate data exposure, not ransomware. The data was released freely to advertise the site.

-

How can I find out if my data was in the BidenCash leaks?

If you’ve made recent online purchases or shared your card on less secure platforms, there’s a possibility your data was scraped. Use PureVPN dark web monitor to get real-time alerts about data exposure.

-

Can stolen data still be used after expiration?

Yes. Even expired card data can be used in phishing or identity fraud when combined with other personal information.

-

Who is responsible for preventing data leaks like BidenCash?

Banks, merchants, and consumers all play a role, but carding marketplaces thrive when security protocols are not enforced by vendors or platforms.

The Bottom Line

Review your accounts, monitor for suspicious activity, and protect your data with vigilance. Your data can be used for malicious intent that you can not even think of. Manage your data with PureVPN, so that you can track if your data is ever used without your authority.