Table of Content

- How Can I Check If My Online Banking Information is on the Dark Web?

- What Should I Do to Protect My Online Banking Information on the Dark Web?

- How Did My Online Banking Information Appear on the Dark Web?

- Can I Remove My Online Banking Information from the Dark Web?

- Frequently Asked Questions (FAQs)

- In Conclusion

A major data breach hit Evolve Bank & Trust when hackers stole customer information, and the bank officials are scrambling to contain the damage.

The notorious group, LockBit 3.0 was responsible for the attack and leaking private information online.

Even though Evolve Bank & Trust is offering credit monitoring service, the damage has been done.

If your banking information appears on the dark web, chances are it may have been stolen and is being traded or sold illegally.

This can put you at risk of identity theft and financial fraud.

This blog guides you about the dangers of banking information leaks on the dark web, how to check if it’s been compromised, and what steps you can take to protect yourself.

How Can I Check If My Online Banking Information is on the Dark Web?

Sadly, there’s no surefire way to check the dark web for your information.

You need to use the Tor Browser to get access to the Dark Web, and then you can scan and search your banking information, which is nearly impossible to find.

But to check if your online banking information is on the dark web, you can use dark web monitoring tools. These tools scan billions of breached data points to check if your credentials appear on the dark web.

What Should I Do to Protect My Online Banking Information on the Dark Web?

If you discover that your online banking information is on the dark web, follow these steps immediately:

Change Your Passwords Immediately

Update your online banking and other related passwords with strong, unique passwords. Avoid using the same password across multiple websites.

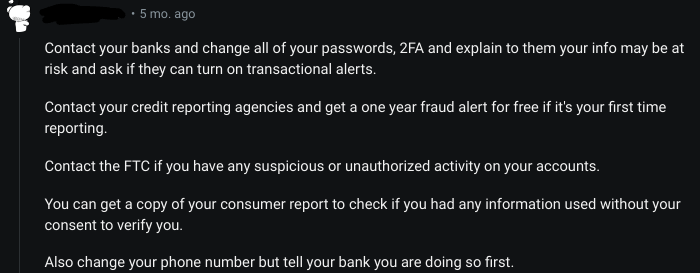

Notify Your Bank or Financial Institution

Contact your bank to inform them of the potential breach. They can help monitor your account and take additional security measures if necessary.

Monitor Your Accounts for Suspicious Activity

Regularly check your bank statements and online accounts for unauthorized transactions or unusual activity.

Place a Fraud Alert or Credit Freeze

Contact credit bureaus to place a fraud alert or freeze your credit, making it harder for thieves to open new accounts in your name.

Report the Incident to the Relevant Authorities

Report the breach to the Federal Trade Commission (FTC) or local police to record the incident and help with the investigation.

Review Your Security Practices and Update Them

Evaluate and strengthen your overall cybersecurity practices, including using two-factor authentication and regularly updating passwords.

How Did My Online Banking Information Appear on the Dark Web?

Your online banking information might appear on the dark web due to these reasons:

Data Breaches

If a company you’ve shared your information with experiences a data breach, your information could be exposed and sold on the dark web.

Phishing Scams

If you fall for phishing scams, your information can be stolen and later appear on the dark web.

Malware Infections

Malicious software can capture your banking information and transmit them to cybercriminals who might then post them online.

Leakage from Unsecure Websites

Using websites that don’t secure your data properly can lead to your information being compromised.

Public Information

Sometimes, the information you share by mistake or that’s publicly available can be collected and sold on dark websites.

To protect yourself, consider using strong, unique passwords, enabling two-factor authentication, and regularly monitoring your accounts for unusual activity.

Can I Remove My Online Banking Information from the Dark Web?

Once your online banking information ends up on the dark web, it can't be removed. The best course of action is ro act quickly to protect your accounts and lock banking details.

You can also use Dark Web monitoring alerts to check if your information shows up again, update your passwords regularly, and turn on multi-factor authentication for all your accounts.

Fortunately, you can use PurePrivacy that offers Dark Web monitoring to scan and search the platform whenever someone posts your personal information, hashed passwords, and credit card details.

PurePrivacy helps secure your personal information with the following privacy-focused features:

- Monitor the dark web for your personal information with Dark Web Monitoring.

- Activate Tracker Blocker to prevent online tracking and data collection.

- Use the Remove My Data feature to automatically request data opt-outs.

- Enhance your privacy on major social media platforms with Social Privacy Manager.

Scan Your Compromised Information on the Dark Web

Stay updated on dark web breaches and get alerts if your information appears there.

Stop Unwanted Trackers and Data Collection

You can block invisible trackers, prevent websites and domains from collecting and selling your browsing data.

Automatically Opt-Out from 200+ Data Brokers

Review and remove your data from multiple data brokers with automated information removal requests.

Enhance Your Social Media Privacy

Use PurePrivacy to check and enhance your privacy settings on social media, keeping your personal information safe.

Frequently Asked Questions (FAQs)

-

What does it mean if my online banking information is found on the dark web?

If your online banking information is found on the dark web, it indicates possible theft and illegal trading of your sensitive information, increasing fraud risk. Protect yourself with PurePrivacy's Dark Web Monitoring, which alerts you if your data appears online.

-

How can I check if my banking information is on the dark web?

To keep an eye on the dark web for your personal information, use PurePrivacy’s Dark Web Monitoring. It will automatically alert you if your data is found, helping you stay aware and take action.

-

What happens if my data appears on the dark web?

If your data appears on the dark web, it means your personal information can be stolen and sold or used for illegal purposes. This can lead to potential fraud, identity theft, or unauthorized access to your accounts.

In Conclusion

With emerging threats and identity fraud becoming increasingly common, it’s crucial to protect your personal information.

Using PurePrivacy and a VPN can help prevent unauthorized access and protect your data from being compromised.