Imagine waking up one morning to find that a massive cyberattack has hit your mortgage lender, exposing your personal and financial information. LoanDepot, one of the largest mortgage providers in the US, suffered a significant data breach that disrupted its operations.

Customers faced login issues, payment delays, and growing concerns over their sensitive data falling into the wrong hands. But what exactly happened, and how did LoanDepot respond to this crisis? Let’s find it out in this blog.

What Happened in the LoanDepot Data Breach?

In January 2024, LoanDepot, a major mortgage company, was hit by a ransomware attack that caused a massive data breach. Hackers broke into their systems, locked essential files, and stole personal information from millions of customers. As a result, many people had trouble accessing their accounts and making payments.

Exposed Details

The breach exposed sensitive details of around 16.6 million people, including:

- Full names

- Addresses

- Phone numbers

- Email addresses

- Dates of birth

- Social Security numbers

- Financial account numbers

When the attack was discovered, LoanDepot shut down parts of its system to stop further damage. They later notified affected customers and provided free credit monitoring to help protect them from identity theft. The company also waived late fees to make things easier for customers who couldn’t make payments due to the breach.

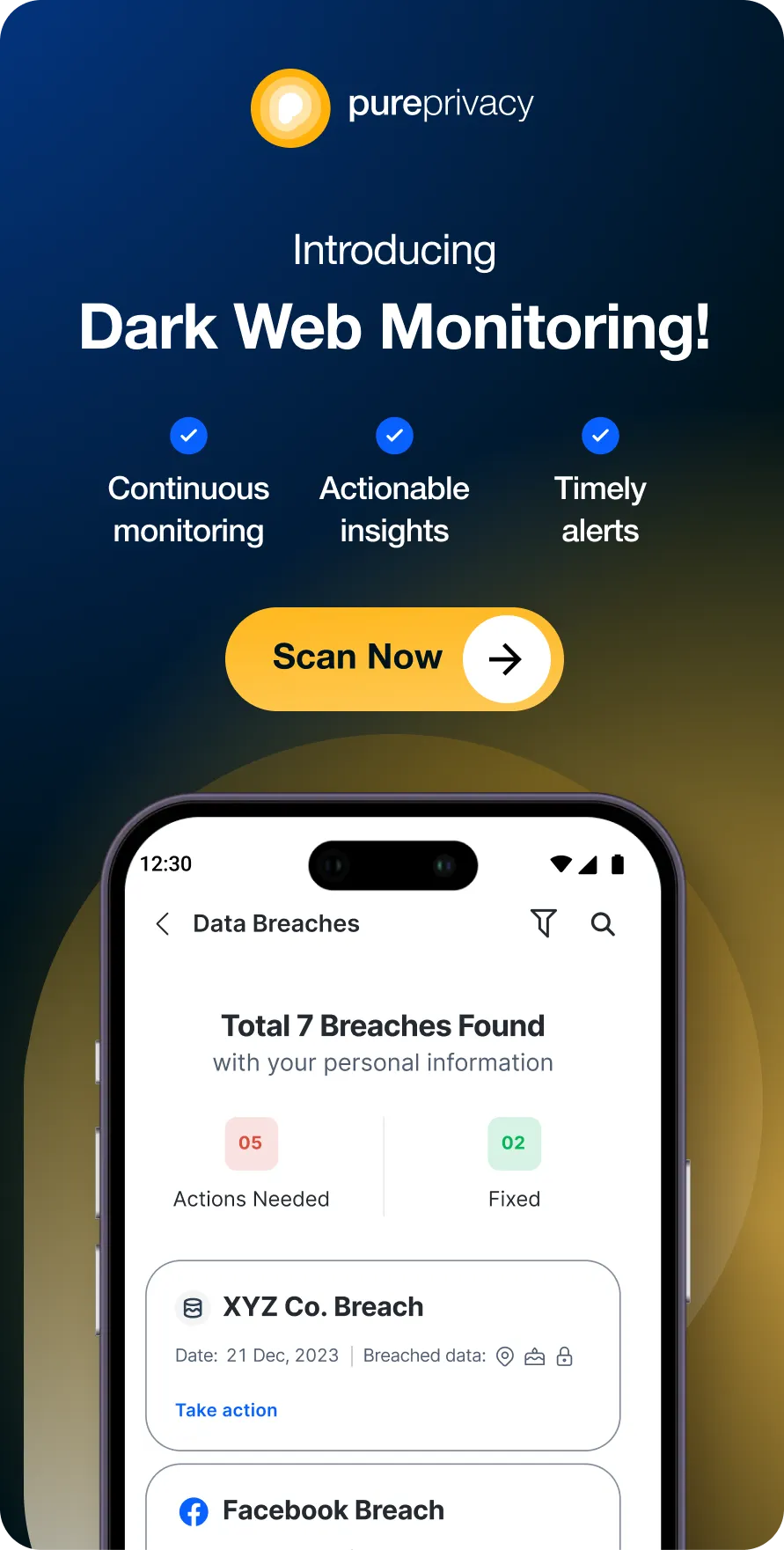

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

What Are the Risks of Exposed Data?

When your data gets exposed, it can lead to serious issues like:

- Identity Theft: Hackers can use your stolen information, like name and Social Security number, to open bank accounts, take out loans, or commit fraud under your name.

- Financial Fraud: Criminals can steal money or make unauthorized purchases if your bank or credit card details are leaked.

- Phishing: Malicious actors send fake emails or messages pretending to be from trusted companies, tricking you into revealing passwords or clicking harmful links.

- Account Takeovers: If hackers get your login details, they can take over your social media, email, or banking accounts and lock you out.

- Blackmail & Extortion: Leaked private data, like messages or financial records, can be used to threaten or blackmail you.

- Reputation Damage: Sensitive information being made public can harm your personal and professional relationships.

What Should I Do in Case of a Data Breach?

If your data is exposed in a breach, here’s how you can protect yourself:

Protect Your Financial and Personal Information

- If you’re worried about your bank details being misused, consider freezing your bank cards to prevent unauthorized transactions.

- Setting up fraud alerts to notify you of any suspicious activity is a good idea.

- If you suspect your Social Security number has been leaked, contact the Social Security Administration for help.

Avoid Phishing and Scams

- Be careful with unexpected calls or messages asking for personal information. Scammers often trick people by pretending to be from a trusted company.

- If you receive a message from an unknown number that looks too good to be true, ignore it.

Keep Your Emails and Passwords Secure

- Use a strong, unique password for your email and enable two-factor authentication for enhanced protection.

- Be cautious with emails from unknown senders; don’t open attachments or click on links, as they could be phishing scams trying to steal your information.

How to Minimize Damage During Data Breaches

Your online information is never safe! Everything can be stolen or bought from the dark web unless you can protect your data, from loan information to court records, divorce records, SSN, name, email, and phone numbers. Here’s what you can do to mitigate the damage:

- Use dark web monitoring to get alert notifications as soon as someone posts your information on the dark web

- Change your passwords, freeze your bank accounts, and avoid clicking on suspicious links in emails or messages

Frequently Asked Questions (FAQs)

-

How did the LoanDepot data breach happen?

Hackers attacked LoanDepot with ransomware, locking their systems and stealing customer information, causing issues like account login issues and delayed payments.

-

What personal details were stolen?

The stolen data included names, addresses, phone numbers, emails, birth dates, Social Security numbers, and bank account details of around 16.6 million people.

-

How can hackers misuse my stolen data?

They can use your information to steal money, open fake accounts, send scam emails, or even take over your social media or bank accounts.

-

What should I do if my data was leaked?

Change your passwords, turn on two-factor authentication, check your bank statements for any strange activity, and set up fraud alerts to protect yourself.

-

Is LoanDepot helping affected customers?

Yes, they offer free credit monitoring and waive late fees for customers who face payment issues due to the breach.

In Summary!

The LoanDepot data breach is a serious reminder of how vulnerable personal information can be in the hands of hackers. Staying alert, securing your accounts, and using privacy tools can help protect you from identity theft and fraud in the future.