From online shopping to everyday transactions, fraud and theft are rising. Protecting your credit card details is no longer optional, it's a necessity if you do not want to lose your hard earned money.

In this guide, we will go over effective strategies to protect your credit card information from prying eyes and how you can use PureVPN’s Dark Web Monitoring to check if it shows up on the dark web.

How to Safeguard Credit Card Information

Hackers and intruders are always looking for your credit card information to commit financial theft. Here are some practical tips you must follow to keep your credit card info safe:

1. Consider an Online Shopping Card

To reduce risk, try a single credit card for all online purchases. You can limit the number of accounts exposed to hackers and simplify fraud monitoring by doing this. Enable purchase alert notifications and opt for guest checkout.

2. Use Virtual Card Numbers

Explore virtual card numbers offered by your bank to generate temporary, one-time-use numbers for online transactions, hiding your actual card details. Even if compromised, these temporary numbers are useless to hackers.

3. Use Strong, Unique Passwords

Set unique passwords for all financial accounts. Avoid reusing passwords across various platforms. Never write them down or use easily guessable personal information. A password manager can help you generate and store robust passwords.

4. Verify Website Security

Only shop on websites with HTTPS. While not foolproof, it reduces the risk of your data getting intercepted by hackers. Be cautious, as even cybercriminals can obtain security certificates.

5. Stick to Reputable Retailers

Prioritize shopping on trusted websites. If a site is unfamiliar, research its reputation. Pay attention to website design as a poorly designed site can be a red flag. Choose established, reputable e-commerce platforms.

6. Connect to Secure Networks Only

Never shop on public WiFi. Stick to secure, private networks for all online transactions. Public WiFi leaves you vulnerable to data breaches, including financial information and passwords.

7. Protect All Your Devices

Use a reliable antivirus on your device to stay protected against malicious software such as viruses, worms, trojans, and spyware while shopping. Plus, make sure the firewall is enabled to further protect yourself from threats.

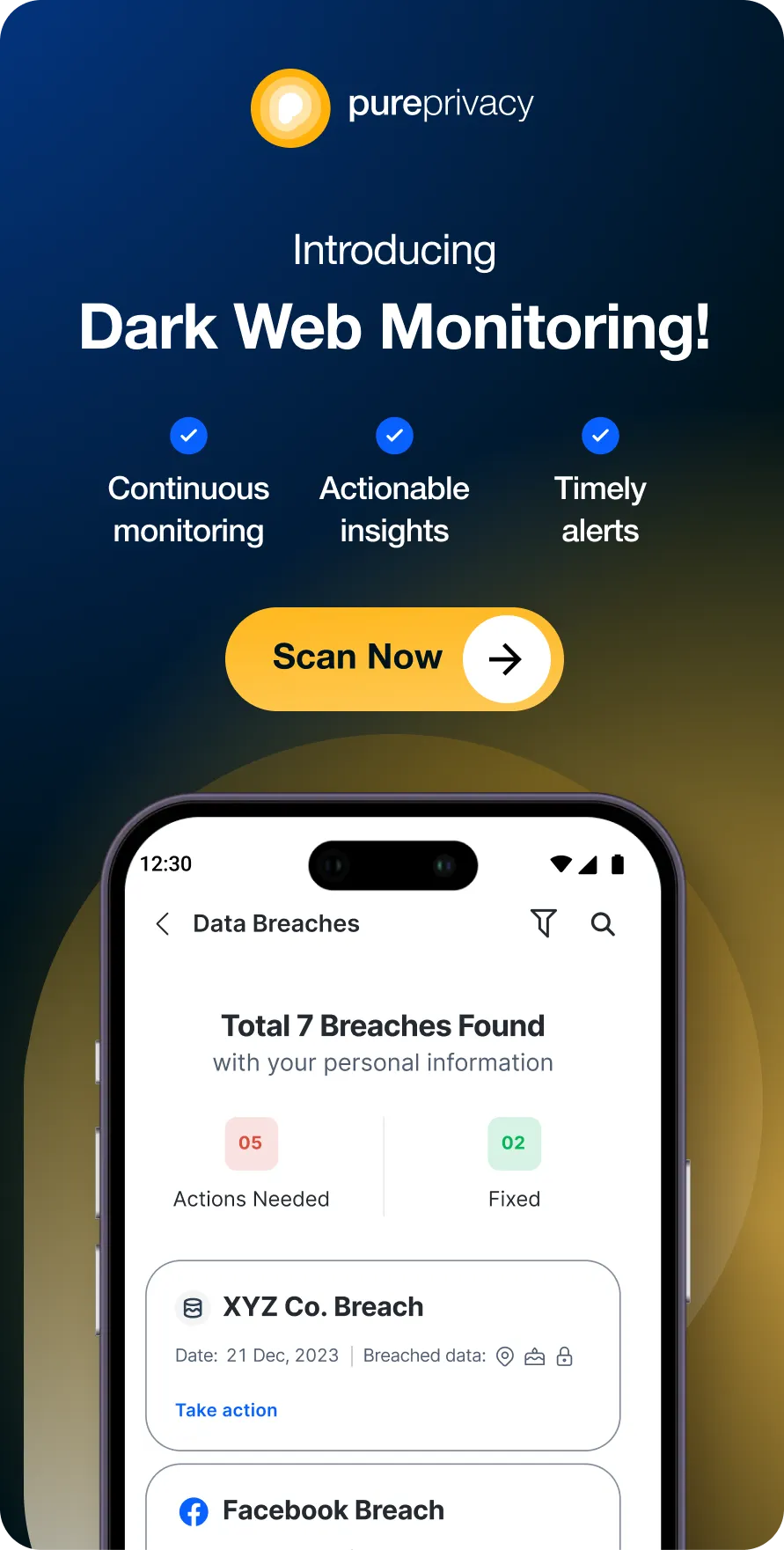

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Is Your Credit Card Compromised?

Detecting credit card fraud early is crucial. Be vigilant and watch for these warning signs that your information may have been compromised and is circulating on the dark web.

1. Unfamiliar Charges

Any purchase you don't recognize needs immediate attention. Hackers often test stolen cards with small charges before attempting larger ones. Pay close attention to transactions from unfamiliar locations.

2. Unexpected Account Changes

Be wary of changes to your account details without your authorization, such as phone number or mailing address. These changes suggest someone is attempting to control. Similarly, password reset requests are a major red flag.

3. Suspicious Alerts and Communication

Treat any unusual notifications with extreme caution. Beware of messages requesting your credit card number, PIN, or other sensitive data. Always verify if you receive any calls or messages from someone claiming to be your bank and avoid sharing private information.

4. Monitor Your Financial Health

Regularly review your credit report for unfamiliar accounts or inquiries. These anomalies could detect if someone is attempting to open accounts in your name.

Immediate Steps You Must Take if Your Credit Card Number is Compromised

- Report the fraud to your bank immediately.

- Change all passwords on online accounts.

- Monitor statements and credit reports for any unauthorized activity.

- Place a fraud alert or credit freeze on your credit.

- File a police report if identity theft occurred.

How to Check if Your Credit Card Data Has Leaked

PureVPN’s Dark Web Monitoring will notify you if your credit card data is leaked and appears on the dark web. It also allows you to track your other critical identifiers like your phone number, email address, and social security number. Receive instant alerts whenever your data is shared on the dark web, and follow the expert recommendations to minimise the damage.

Here's how you can use PureVPN’s Dark Web Monitoring:

- Sign up for PureMax.

- Download and install the PureVPN app.

- Log into your account and click Dark Web Monitoring.

- Select Add Assets to Monitor and enter your email address, SSN/NIN, credit card number, passport number, and phone number in the respective fields.

- Enter the code sent to your registered number to verify your identity, and you’re done.

- Follow the recommendations if your data is found on the dark web to minimize the damage.

How to Prevent Your Credit Card from Being Used By the Scammer

To prevent unauthorised credit card payments, there are some additional tips you can follow:

- Implement a Strict Credit Limit: Set a daily credit limit with your spending. You can track fraud losses and facilitate immediate detection by doing so.

- Enable Transaction Alerts: Make sure you real-time notifications for all transactions via SMS, email, or WhatsApp are enabled.

- Restrict Geographic Transactions: Use location-based restrictions to limit transactions to the place you live or travel.

- Conduct Regular Statement Reviews: Consistently review your credit card statements to identify and address any unauthorized activity promptly.

- Lock Unused Credit Cards: Secure infrequently used cards by locking them when not in use to prevent unauthorized access.

- Use Low-Limit Cards for Subscriptions: Use dedicated, low-limit cards for online subscriptions to mitigate risks associated with data breaches.

Frequently Asked Questions (FAQs)

-

How do I stop someone from taking money from my credit card?

You can take some measures to protect any unauthorized transactions, including contacting your bank or credit card company as soon as you notice any unauthorized activity, regularly checking your statements for unfamiliar charges, setting up notifications for all card activity, etc.

-

How do hackers keep getting my credit card info?

If your credit card data is repeatedly exposed, you might have been a part of a large-scale breach, fallen victim to phishing or malware, or had your credit card information leaked on the dark web.

-

What if my credit card is on the dark web?

Your financial identity is at risk if your credit card is on the dark web. It can damage your credit score and could lead to identity theft, which might have long-term consequences.

Wrapping Up

Financial theft is not just a loss of money—it also means your personal data is in dangerous hands. Therefore, it’s crucial to shield your sensitive information from cyber intruders and hackers. Stay vigilant and proactive to prevent your credit card and other data from leaking to dark web marketplaces, and use PureVPN’s Dark Web Monitoring to stay in the know if it does.