Your Financial Data Could Be at Risk!

Data breaches are becoming more common, and the recent SouthState Bank data breach has raised serious concerns for thousands of people. If you’ve ever used SouthState Bank, it’s important to stay alert because your personal and financial information could be at risk.

This wasn’t just a minor issue. More than 840,000 people were affected, and the breach involved highly sensitive data. Read this blog to know what happened, what kind of information was exposed, and how you can protect yourself moving forward.

What Happened in the SouthState Bank Data Breach?

On February 7, 2024, SouthState Bank identified unauthorized access to certain folders in its system. It was discovered that cybercriminals had infiltrated the bank’s network and potentially accessed confidential personal and financial data of customers across several states, including Florida, Alabama, Georgia, North Carolina, South Carolina, and Virginia.

Data exposed in the breach included:

- Full names

- Social Security Numbers

- Financial account numbers

- Addresses

- Phone numbers

SouthState Bank quickly launched an investigation, secured the affected systems, and notified those impacted. They also offered free credit monitoring services to help reduce the risks of identity theft.

What Are the Risks of Exposed Data?

When sensitive data falls into the hands of hackers, the consequences can be serious and long-lasting. Here’s what you could be facing:

- Identity Theft: Hackers can use your SSN and other personal information to open fake accounts or apply for loans.

- Financial Fraud: Your data can be sold on the dark web and used for unauthorized transactions.

- Phishing Attacks: Scammers can impersonate your bank or other institutions to trick you into revealing more information.

- Account Takeovers: If any login details were exposed, attackers could gain access to your financial or online accounts.

- Future Threats: Even if nothing happens immediately, your data could be misused months or even years later.

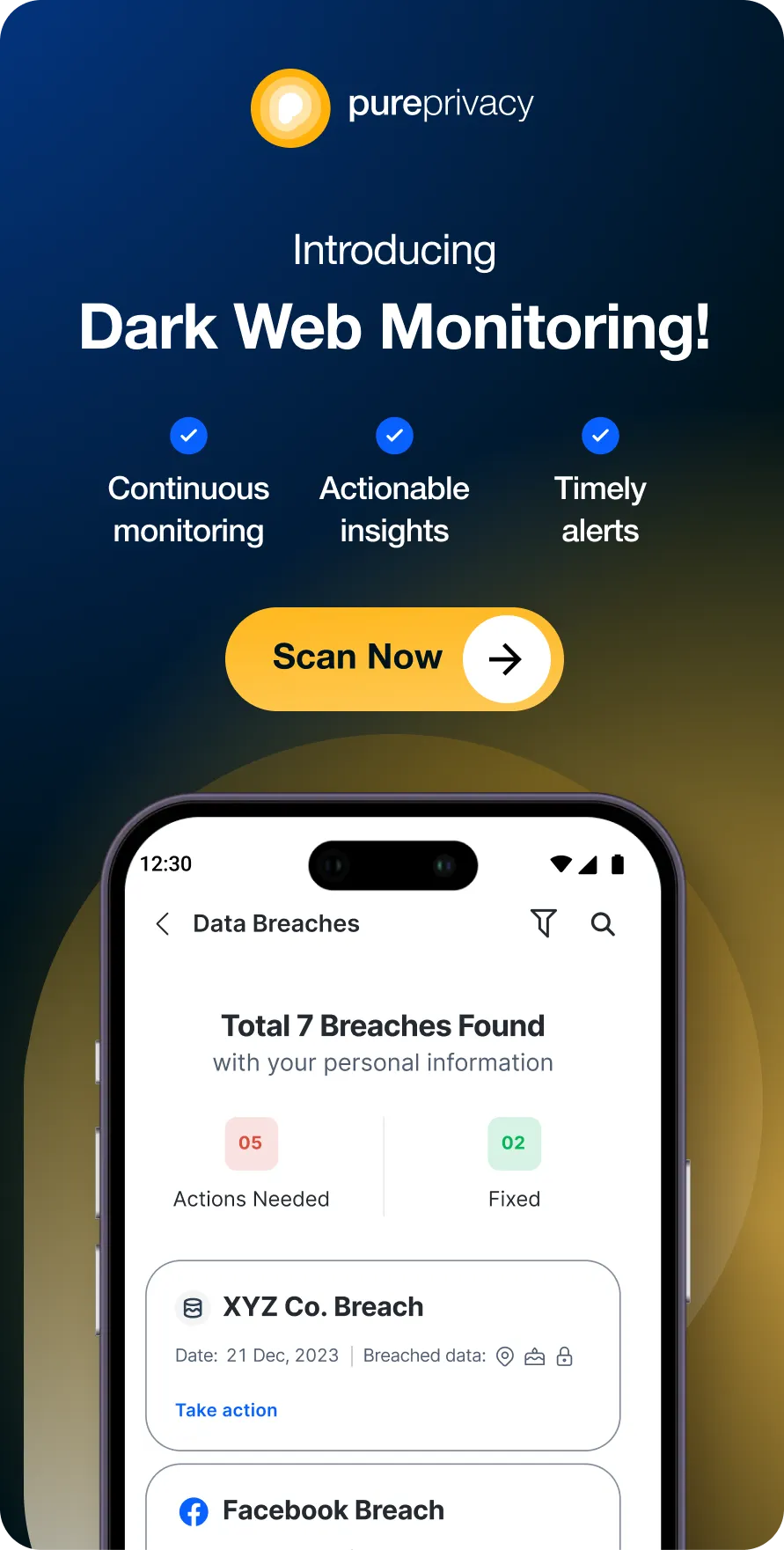

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

How Can You Protect Yourself from Data Breaches?

If you believe your data was exposed, take these actions now to minimize potential damage:

Monitor Your Financial Accounts

Keep a close eye on your bank statements, credit card bills, and transaction history. Report immediately if you notice anything unusual.

Change Your Passwords

Change your passwords for banking and other important accounts. Use strong, unique passwords and enable two-factor authentication (2FA) where possible.

Place a Credit Freeze

Consider placing a credit freeze with the major credit bureaus to prevent new credit accounts from being opened in your name without your permission.

Be Cautious of Phishing Scams

Watch out for suspicious emails, texts, or calls pretending to be from your bank. Never share personal information without confirming the source.

Use Dark Web Monitoring

To stay extra safe, you should use PurePrivacy’s Dark Web Monitoring. It constantly checks whether your data has appeared on the dark web and alerts you timely.

Here’s how you can get started:

- Install or update PurePrivacy on your device.

- Log into the Members Area.

- Go to the Dark Web Monitoring section.

- Select Add Assets to Monitor.

- Add your email, phone number, and other crucial identifiers.

- Verify via the code sent to your registered number.

- Follow recommended actions if your data is found to be in breach.

- Mark breaches as resolved once you've taken corrective steps.

Frequently Asked Questions (FAQs)

-

How do I know if my information was affected in this breach?

SouthState Bank should’ve sent you a notice if your data was involved. But if you didn’t get anything, don’t assume you’re safe. It’s smart to use PurePrivacy’s Dark Web Monitoring, it checks if your information is out there and alerts you instantly.

-

What should I do if my data is found on the dark web?

First, don’t panic. Change your passwords right away, let your bank know, and keep a close eye on your accounts. Follow the actionable steps if your information shows up during dark web scans.

-

Can this still affect me if I’m not a customer anymore?

Yes, it can. Even if you closed your account years ago, your old data could still be in their system and now in the wrong hands. Stay alert and monitor your identity regularly.

-

Is credit monitoring enough to stay safe?

It helps, but it’s not everything. Credit monitoring tells you after something suspicious happens. Combine it with PurePrivacy’s Dark Web Monitoring to catch threats before they cause trouble.

-

What’s better, a credit freeze or a fraud alert?

Both protect your credit, but a freeze is stronger. It stops anyone from opening new accounts in your name. A fraud alert just tells lenders to be careful. After a breach like this, a freeze is the safer bet.

In Summary!

The SouthState Bank data breach shows us that no system is completely safe from cyberattacks. But that doesn’t mean you can't do anything. By monitoring your accounts, using strong passwords, and turning on Dark Web Monitoring with PurePrivacy, you can stay a step ahead and protect your online life.

So don’t wait until it’s too late, take action today and stay secure in the online world.