Table of Content

Varo is a mobile banking app with a range of functions.

However, if you want to end your account, we can help.

This guide will walk you through the process of deleting your Varo account.

What is Varo?

Varo is an internet bank, primarily a mobile banking app, designed to make managing your accounts simple and economical. Unlike typical banks with physical branches, Varo operates entirely online.

They provide benefits like bank and savings accounts with high-yield interest, the possibility to receive your paycheck up to two days early, and a network of ATMs for fee-free withdrawals.

They also emphasise avoiding hidden costs and giving tools to help you save money and build credit.

Why Is It Important to Delete Your Varo Account?

Here are the reasons why you might want to delete your Varo account:

Switching Banks

If you have found a new bank that better meets your needs, cancelling your Varo account prevents you from being tempted to overspend by having numerous accounts.

Safety Concerns

If you detect fraudulent activity or are concerned about the security of your data, cancelling your account can be a preventative action.

Minimising Spending Habits

If you are trying to control your spending and having a Varo account nearby is making it difficult, cancelling it can help you stick to your budget.

Unused Account

If you rarely or never use your Varo account and have no plans to do so in the future, deleting it avoids dormancy fees and streamlines your financial activity.

How to Delete Your Account from Varo

Varo does not allow the account deletion process directly on its website; however, this is how you can get it deleted:

Delete Via Customer Support

- You can reach Varo's customer service staff by calling 1-877-377-VARO.

- Once connected, tell the agent that you wish to close your account.

- Be prepared to answer inquiries about your identification and account ownership.

- The customer support expert will walk you through the closure process and most likely ask about the reason for closing your account.

Important Things to Consider Before Deleting Your Varo Account

Here are some key factors to consider before cancelling your Varo account:

Transfer the Remaining Balance

When closing your checking or savings account, make sure to transfer the remaining funds. Varo does not charge monthly maintenance fees, but there's no purpose in keeping money in an inactive account that you won't use.

Disable Automatic Transfers

This includes salary deposits, bill payments, and transfers to other accounts. Disabling them avoids future problems.

Understand the Closing Process

Varo may impose certain waiting periods or account closure limits. Inquire with customer service about the timing for closure and any potential restrictions.

Future Use

Varo accounts do not incur dormancy fees, so if you think you might want to use them again someday, keeping them open might be easier than going through the closure process to reactivate them later.

Alternatives to Closure

If you are dissatisfied with some parts of Varo but want to keep your account active, contact customer service to see if they can resolve your issues.

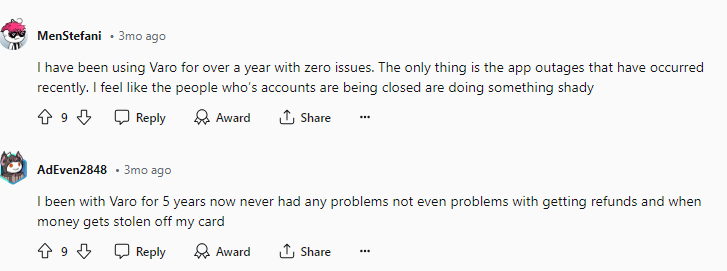

Is Varo Considered a Safe Platform?

Varo is widely regarded as a secure platform for your finances. It uses industry-standard security methods, such as encryption and fraud detection, to safeguard your information.

However, like any other financial institution, it is not immune to security concerns. Phishing scams and viruses that aim to steal login credentials are still an issue.

PurePrivacy protects your Varo account and any linked financial accounts. Hackers might try to steal your Varo information by hacking your social media accounts, so PurePrivacy, with its unique safety features, helps reduce this danger.

PurePrivacy Empowers You to Manage Online Privacy

PurePrivacy is a complete privacy safety app that allows you to take control of your online privacy and protect your personal information.

It focuses on protecting your social media accounts and removing your information from data brokers.

PurePrivacy's features help you boost your online presence while reducing the risk of identity theft and data breaches.

How PurePrivacy Keeps You Protected

Add Social Media Accounts In-App

- Simply connect to your social media accounts (Facebook, Instagram, etc.) within the PurePrivacy app.

- Allow PurePrivacy to analyse your social media settings and provide recommendations to improve your privacy.

Recommendations to Improve Privacy

- PurePrivacy examines your social media settings to identify weaknesses that could compromise your privacy.

- It provides specific measures you can take to mitigate the risks and improve your overall security posture.

Automatically Delete Search History

- PurePrivacy offers a simple way to delete your search history across several social media networks. This helps keep your internet activity private.

- By removing your search history, you reduce the amount of information that social media channels can collect about your interests and browsing patterns.

Scan/Rescan Social Media Settings

- Analyse your social media settings after joining your accounts to uncover any privacy risks.

- Rerun the scan to get updated recommendations based on any changes you have made to your settings or the platforms.

Frequently Asked Questions (FAQs)

-

How will I know if my Varo account has been closed?

For more information, see your Account Closure email. To check their terms and disclosures, go to the Varo Bank Account Agreement, which can be found on our Privacy and Legal page. Visit the Privacy and Legal page here.

-

How can I delete a transaction in Varo?

A payment can be cancelled during the Pending period. Navigate to Move Money > Transaction History > Varo to Anyone History > Select the transaction and click Cancel Transaction. If you need to change the recipient information or payment amount, you can press Cancel before completing a transaction.

-

How do I cancel my Varo bank transfer?

You can only cancel a payment if the recipient has not yet registered with Zelle. To see if the payment is still unpaid because the recipient has not yet enrolled, navigate to your Activity page, select the payment you want to cancel, and then click on the Cancel This Payment button.

-

Is Varo a PayPal?

Yes, Varo Bank works with PayPal. You can also find an official mention from Varo Bank in their support section confirming that Varo works with PayPal. You can add your Varo bank account as a funding source for PayPal and transfer funds from PayPal to your Varo bank account.

Delete Your Varo Account and Gain Confidence

Removing your Varo account is a straightforward process, but you should consider the benefits and downsides before proceeding.

Varo is usually regarded as secure, but for added protection of your online privacy, try using applications such as PurePrivacy.

If you opt to keep your Varo account, you can contact customer care to see if they can resolve any issues you may have.