Table of Content

Think your Capital One 360 account is safe? Think again! Cyberattacks are on the rise, even targeting major financial institutions. The previous year, 50% of UK companies reported experiencing security breaches or cyberattacks.

While Capital One 360 offers security features, you need to take extra steps to protect your personal information. This guide explains how you can protect your information on Capital One 360.

How Does Capital One 360 Gather Your Data?

Your information is gathered in a variety of ways by Capital One 360, mainly to enhance your overall banking experience and offer customized financial services.

This includes data gathered automatically from your interactions with Capital One's online platforms and mobile apps and information you voluntarily submit when you open an account or complete a transaction.

Types of Information Capital One 360 Gathers

Capital One uses this information to better understand your requirements and preferences by analyzing your financial behavior, improving security measures, and customizing offers. They gather your information in the following ways:

Personal Information

They gather personal information such as name, address, Social Security number, birth date, contact details, employer, employment title, earnings, and duration of service.

Financial Data

They collect your financial information, including credit bureau data, work, investments, and rental income as sources of revenue. Details regarding active accounts, including loans, credit cards, savings, and checking, are also included.

Details of Transactions

They maintained a log of every transaction, withdrawal, and deposit. Spending behaviors and trends are also monitored to detect any fraud.

Additional Details

They also collect details regarding your financial goals, including housing, retirement, and education savings, and evaluate your readiness to accept financial risks.

Why Is It Important to Understand Capital One 360's Privacy Policy?

You can protect your personal information and make well-informed decisions about your financial connection by reading Capital One 360's privacy policy. Understanding Capital One 360's privacy policy is important for several reasons.

Protection of Personal Data

This policy describes how your personal data is gathered, processed, and shared by Capital One. By being aware of this, you can ensure your data is handled safely and according to your wishes.

Effective Data Management

The policy explains whether and why Capital One shares your information with outside parties. You can use this information to make well-informed decisions regarding your financial arrangement with the organization.

Acknowledgment of Your Customer Rights

The privacy statement frequently lists your rights as a customer, including the ability to view, amend, or remove your personal data. Being aware of your rights might help you take ownership of your data.

Compliance with Data Privacy Laws

Capital One provides many regulations to protect your data. By familiarizing yourself with its privacy statement, you can ensure the business abides by these legal obligations.

Prevent Identity Theft

A robust privacy policy can lower the risk of identity theft by preventing unauthorized access to your personal information.

How to Protect Your Personal Information on Capital One 360

Capital One 360 is committed to protecting your private data. However, you must promptly protect your account and stop illegal access. Here are some effective tactics to think about.

Use Strong and Unique Passwords

Use capital and lowercase characters, digits, and symbols. Don't use the same password across several accounts. Consider using a password manager to develop and save strong passwords safely.

Enable Multi-Factor Authentication

Go to the settings of your Capital One 360 account and activate multi-factor authentication. This increases security by requiring a code to be delivered to your email or phone to log in.

Review Transactions Daily & Enable Notifications

Regularly check your account for any fraudulent activity. Set up SMS or email notifications to notify you of any strange activity, such as major withdrawals or login attempts from places you're not acquainted with.

Use Antivirus & Updated Software

Install and update your devices' antivirus software. On your mobile devices, use biometric authentication or strong passcodes.

Report any Suspicious Account Activity

Contact Capital One immediately if you think your account may have fraudulent activity. See the Capital One website for information on certain security policies and tools.

Prevent Identity Fraud and Online Tracking With PurePrivacy

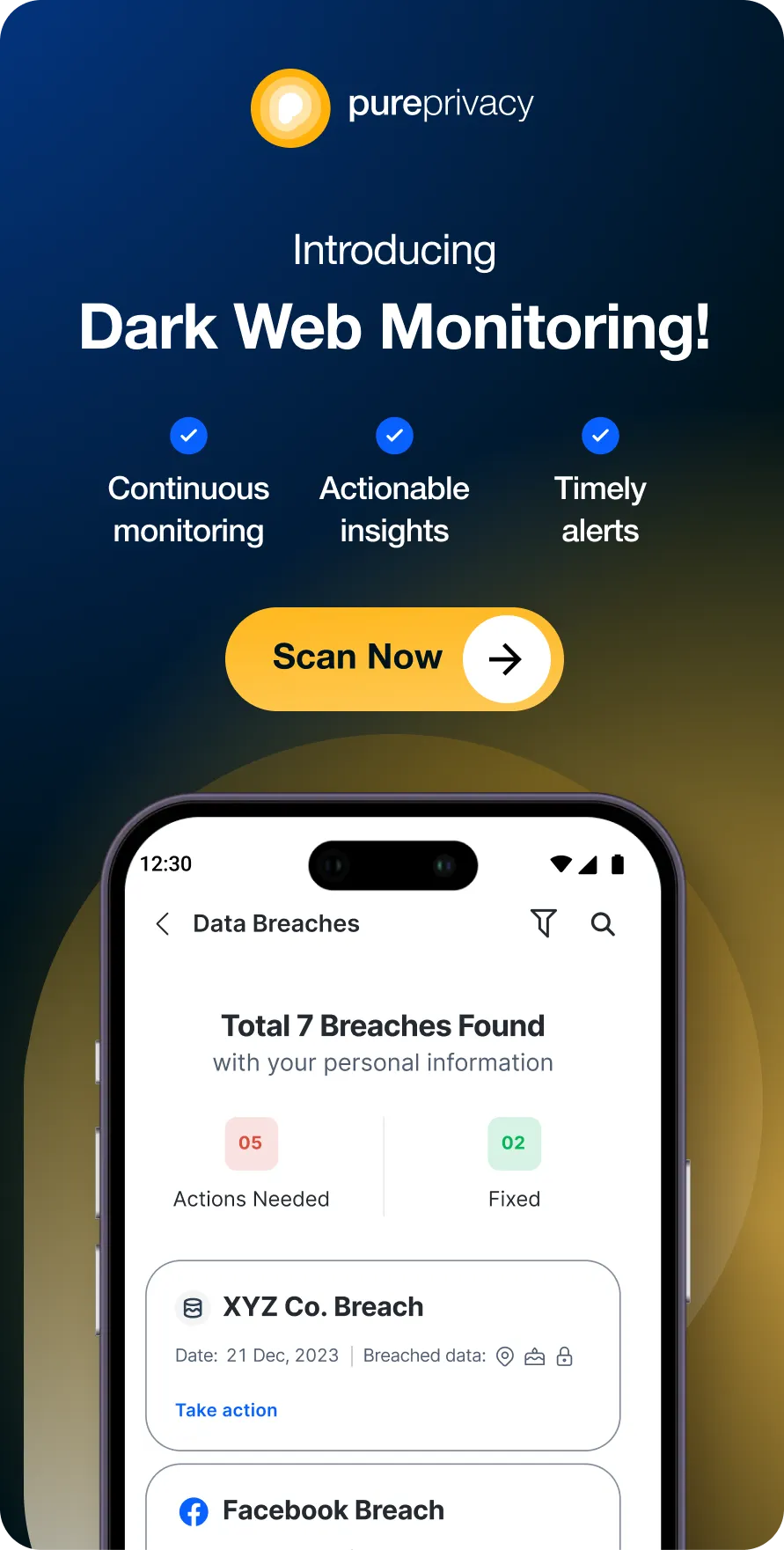

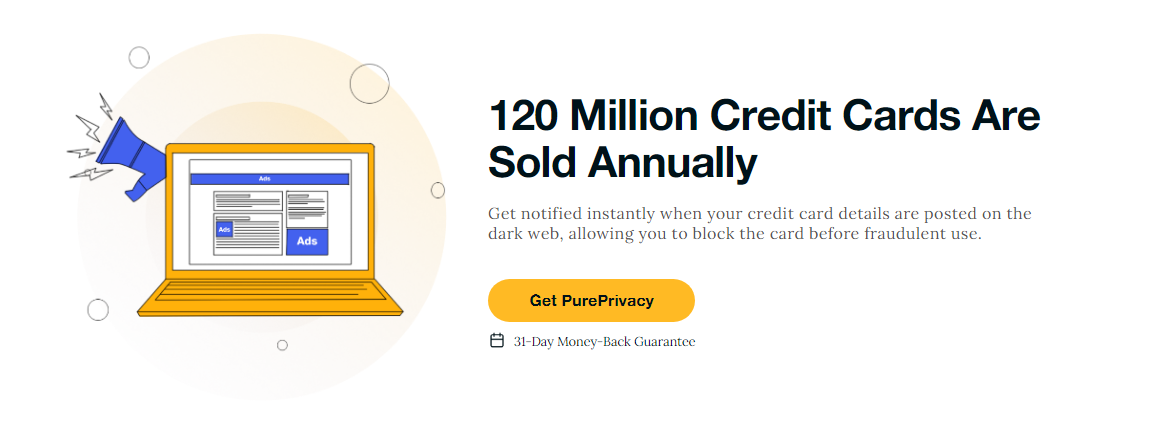

PurePrivacy is the most effective solution for protecting against online data theft risks. It keeps your personal information hidden from prying eyes and boosts online privacy.

- Dark Web Monitoring: Stay ahead of data breaches and protect your identity.

- Tracker Blocker: Stop invasive tracking and safeguard your privacy.

- Remove My Data: Eliminate your digital footprint and reduce identity theft risks.

- Social Privacy Manager: Take control of your social media privacy settings.

Monitor the Dark Web

To prevent identity theft, proactively identify and resolve any breaches of personal information on the dark web.

Avoid Unwanted Access

Reduce the amount of trackers that disrupt your surfing experience by using a tracker blocker to improve page performance.

View Removal Requests

Get rid of any harmful or out-of-date content that could damage your reputation and view data removal requests to track data removal progress.

Prevent Unwanted Tracking

Prevent unwanted access to your surfing history and improve your device security by deleting your search history automatically.ng history and improve your device security by deleting your search history automatically.

Frequently Asked Questions (FAQs)

-

How can I keep my Capital One account safe?

How can I protect my account with Capital One? With smartphone features like fingerprint ID, face recognition, real-time notifications, debit card lock/unlock, and more, you can contribute to the security of your Capital One account.

-

Does Capital One share my private data?

Yes, they may give information to Capital One family entities and business associates to improve or provide goods and services to Capital One clients or potential clients.

-

What privacy concern does Capital One have?

On July 19, 2019, we discovered that someone outside of Capital One had gained unauthorized access to personal data pertaining to applicants for credit card products and Capital One credit card holders. This took place on March 22 and 23, 2019.

-

Is the Capital One app safe to use?

Yes, it is safe to use because it provides several safety features employed by the Capital One Mobile app to secure your account. These security features include two-step authentication and real-time fraud and purchase alerts, as well as a card lock function that lets you prevent unauthorized users from using your lost or stolen card.

In Conclusion!

Getting unbanned from Omegle isn’t impossible, but it requires patience and following the right steps.

Whether you’re using a VPN or appealing directly to Omegle, remaining respectful during the process will increase your chances of success.

To ensure your privacy while browsing and chatting, consider using PurePrivacy with a VPN to protect your data and maintain a safer online experience.