Table of Content

Providing your contact information is simply one of the few easy steps needed to get approved for Klarna. The process is straightforward for registering on Klarna. However, if you want to remove or change your phone number, you must be curious about the process.

In this blog post, we'll go over how to update your contact information like phone number in Klarna. We'll address some of the most frequently asked queries about the changes you may want to make to your Klarna account data.

What is Klarna?

Klarna Bank AB, also known as Klarna is The Swedish fintech business that offers online financial services. The business handles consumer payments and store claims while offering payment processing services to the online retail sector. Because it's so simple to apply for and use, Klarna is one of the most prominent Buy Now, Pay Later choices available. Even returns are also provided by the service.

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Why Should You Remove Your Phone Number from Klarna?

For additional security against data breaches, you can think about removing your phone number from Klarna or similar platforms. Anyone can verify an account holder's data by looking up their phone number or email address using the PayID lookup service.

Hackers can carry out an enumeration attack because of this vulnerability. Sending messages under the cover of a reliable company is a common method scammers use.

One data breach incident occurred in a fintech company, Westpac, in which the hackers discovered 98,000 Westpac customers' banking information including phone numbers and email addresses. In such a case, removing your number reduces the amount of data that is exposed.

How to Remove Your Phone Number from Klarna

Follow these simple steps if you want to remove or change your phone number from your Klarna account.

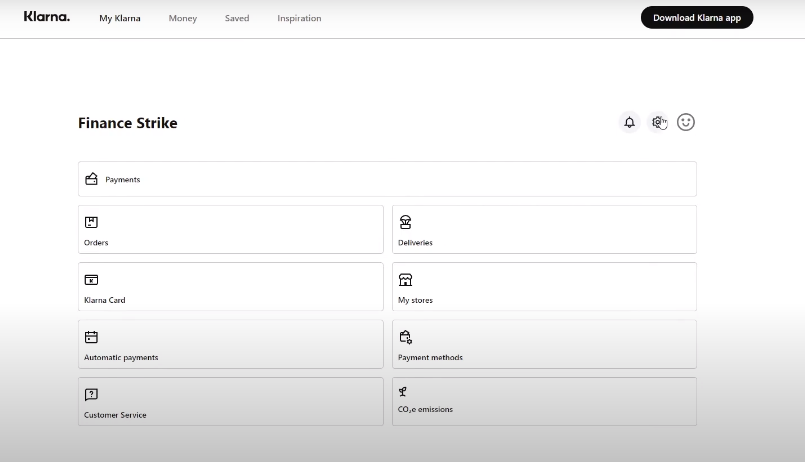

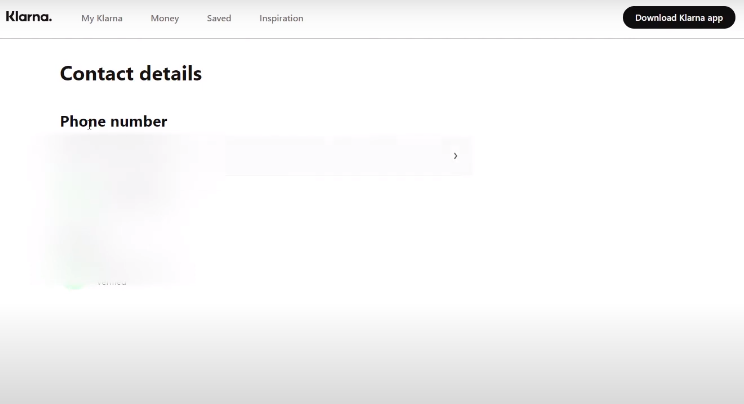

Step 1: Click on the Settings icons after signing in to your Klarna account.

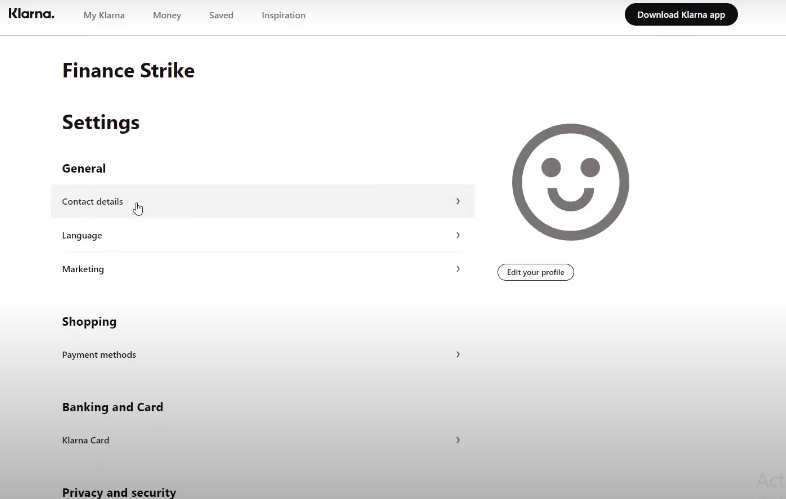

Step 2: From there, select Contact details.

Step 3: Clicking on contact details, you will see your phone number.

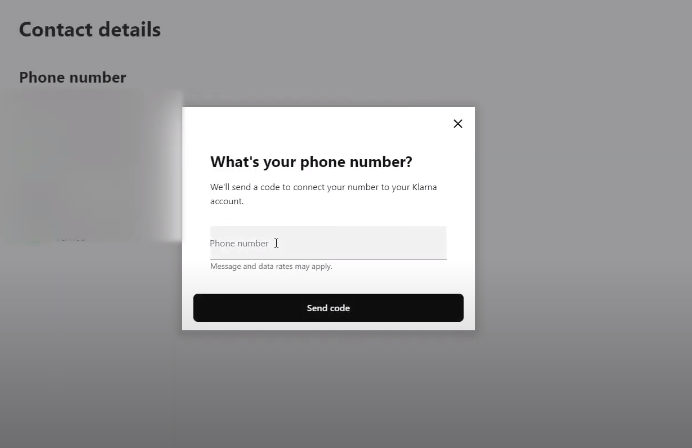

Step 4: Now, click on the phone number. A small window will pop up, insert another phone number that you wish you could change.

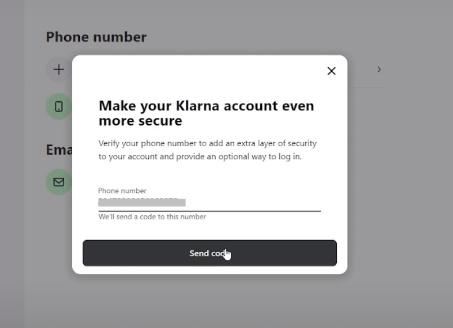

Step 5: Tap on Send Code after typing your new phone number.

Step 6: Verify the code and there you will get your phone number changed.

Is Klarna Secure?

Yes, you don't have to worry about how you're going to pay the entire price for anything when you purchase with a buy now, pay later firm. That's the reason you first chose to use Klarna.

However, making purchases now and paying for them later only postpones the inevitable—having to worry about where you'll get the money in the future. Furthermore, Klarna doesn’t affect your credit score. Unpaid debts are eventually turned over to collections even though Klarna might not disclose your information to credit agencies.

Is Shopping with Klarna Really Better?

Numerous retailers collaborate with installment payment plan providers such as Klarna. Because when they collaborate with them, they make a tremendous amount of money.

By reducing your total cost by 75%, these services deceive you into spending more money, giving you much more room in your shopping basket. Because you will be spending a lot more, and those payments will produce holes in your budget that will last for months.

Businesses that use Klarna's app will see a 45% rise in typical shop orders, the company boasts. This indicates that because they don't have to pay for everything at once, the typical consumer is spending 45% more on items they can't afford.

You might be more likely to make purchases when they see a lower number, regardless of their financial status. Your future self will appreciate you if you stay away from Klarna and others, buy now, pay later services, and establish such healthy financial behaviors.

Frequently Asked Questions (FAQs)

-

What are Klarna's benefits and drawbacks?

You will not pay interest while using Klarna's Pay for your purchases. Customers may more easily spread out their payments over time without incurring interest on a credit card thanks to the interest-free loans. You would have to pay interest on those loans if you choose to use its longer-term funding.

-

Why is my credit score being negatively impacted by Klarna?

But, Klarna may report you to credit reference bureaus if you don't complete your repayments on time, which might have a bad effect on your credit score. Applying for financing and taking a payment holiday with Klarna may potentially have a negative impact on your credit score.

-

Why is Klarna better than PayPal?

In the BNPL market, Klarna is a more well-known name and offers a wider selection of payment choices to consumers. For customers, the absence of late fees is another big plus; they could even choose it over PayPal Credit.

-

Does Klarna approve your account in any case?

Our automatic approval choices are based on your data that is readily available, mostly provided by credit agencies. This data includes details on your credit history, including whether you have a history of timely payments or excessive amounts of outstanding debt from other sources.

Protect Your Data While Using Fintech Services!

Removing your phone number might reduce the amount of data that is compromised in a breach and lessen your vulnerability to phone scams. Keep in mind that this may restrict access to some conveniences, such as SMS notifications. The decision is based on how important data security is to you in comparison to usability.