Table of Content

Equifax is a credit reporting company that offers credit record monitoring, SSN search, and background checks and reports.

In September 2017, Equifax disclosed a data breach involving 147 million people's personal information.

Equifax has agreed to pay up to $425 million as part of a global settlement with the FTC, CFPB, and U.S. states to help harmed individuals.

By reading this blog, you can take charge of your security and personal data. You can also protect your privacy by using PurePrivacy, which can also assist in deleting data permanently.

Key Takeaways

- Equifax is a credit reporting company that provides data for marketing lists.

- Ensure privacy by following the manual method to opt out.

- You can also use PurePrivacy to opt out automatically.

- PurePrivacy is a tool that helps you to enhance the privacy of your data.

What is Equifax?

Equifax Inc. is a US-based worldwide consumer credit reporting organization located in Atlanta, Georgia. It is one of the three main consumer credit reporting companies, alongside Experian and TransUnion.

Globally, Equifax gathers and compiles data on over 88 million organizations and over 800 million individual consumers. In addition to services to businesses and credit and demographic data. Equifax offers fraud protection and credit monitoring services directly to customers.

How Does Equifax Gather Information?

The following categories of information are included in your Equifax credit report:

Identification information

It includes your name, address, Social Security number, and date of birth.

Details of a credit account

Your lenders and creditors transmit this information to Equifax, which contains details on each account and its payment history.

It might not include all of your credit accounts for a variety of reasons, like closed accounts that vanished from your record after a predetermined amount of time or accounts that lenders failed to submit to Equifax.

Information requests

Two categories of requests exist: "soft" and "hard." When you check your credit or when a business pulls your credit report to make pre-approved credit or insurance offers, these are known as soft inquiries. They do not affect your credit ratings.

Hard Inquiries occur when businesses or people check your Equifax credit report as a result of your credit or service application.

Although the effect might gradually diminish, they might have a detrimental influence on credit ratings.

Bankruptcies

Details about public bankruptcy records, including the filing date and chapter (kind of bankruptcy) and associated information.

Accounts in collections: Overdue accounts that have been given to a collection company.

Why Is It Important to Opt Out from Equifax?

Removing your Equifax account is essential for improved security and privacy. By doing this, people lower the chance of identity theft by limiting the exposure of their data.

This option reduces unsolicited offers and gives them more control over who can view their credit information. But, since lenders frequently use credit reports for evaluation, it's crucial to understand that opting out may have consequences when applying for credit or other financial services.

Therefore, before choosing to opt out, people should carefully consider the advantages of improved privacy against any potential consequences on their ability to use particular services.

With Opt-Out Prescreen, you can stop receiving Equifax reports. Creditors and providers use these lists, which contain personal information, to make hard offers of credit or insurance.

You have to fill up and mail their opt-out form to get removed from the Opt-out Prescreen. It's unclear how long it will take them to remove your information after this.

How to Opt-Out & Remove Information From Equifax

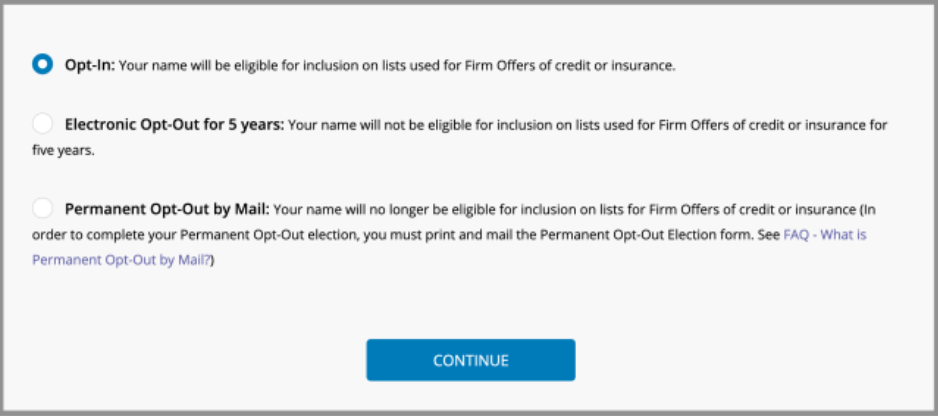

- Visit https://www.optoutprescreen.com/selection to access their online form.

- Choose "Permanent Opt-Out by Mail" at the bottom, then click "Continue."

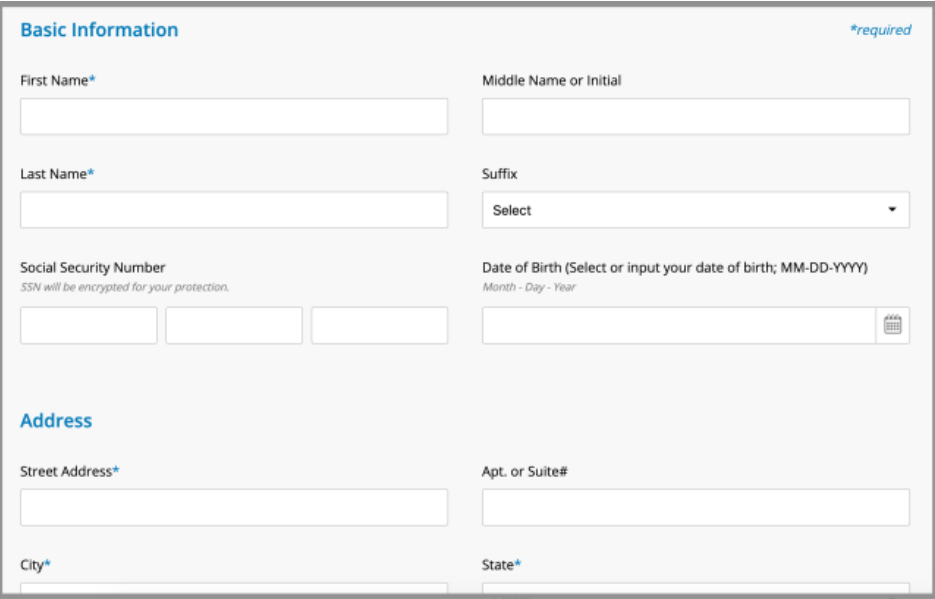

- Your name and address will be requested. We advise against disclosing your date of birth and social security number since they are not necessary.

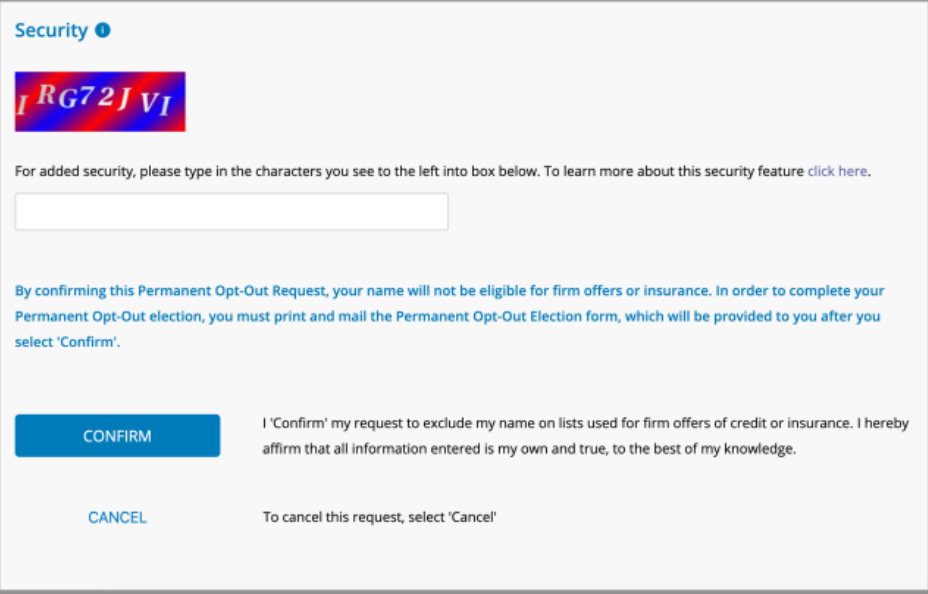

- After completing the security letters, press "Confirm."

- Fill out the "Permanent Opt-Out Election form" and mail it to:

- Innovis Consumer Assistance

- PO Box 495

- Pittsburgh, PA, 45230-1689

The delivery of your letter and the deletion of your information from their database can take some time.

Manual Opt-Out Vs. PurePrivacy

- You have to send an email or fill out an opt-out form.

- You have to always communicate and then follow up.

- The platform's policies determine the effectiveness of opting out.

- The process will take time.

- It supports the opt-out method automatically.

- Effectively controls privacy across a variety of devices.

- Guarantees total data erasure for improved privacy at no cost.

- When your data is deleted, you will be notified and it will function based on your settings.

Frequently Asked Questions (FAQs)

-

How long does it take to opt out of Equifax?

By logging into your Equifax account and selecting My Account/Privacy/Settings, you may also disable the receipt of promotional mailings.

The updating of your lists may take up to 7 or 10 business days. Emails for non-marketing Equifax products, such as credit monitoring alerts, will still be sent to you.

-

Is Equifax safe and trusted now?

Their security capabilities currently surpass every significant industry standard in numerous independent reviews.

Before being sent to or from their servers, credit card numbers and Social Security numbers are encrypted. Their website demands the use of a 128-bit SSL-compliant browser for your protection.

-

Does Equifax sell my data?

They collect, process, and market personal information for their business credit reporting services. These services enable their clients to make well-informed choices about lending money to or investing in companies.

-

What is Equifax & Why is it used?

Equifax is a credit reporting agency that compiles data about a person's credit history to produce a credit report. Personal information, credit accounts, inquiry information, bankruptcies, and collections accounts are the five primary parts of an Equifax credit report.

Make Data Security Your Top Priority!

To protect yourself from having your information shared, you must opt-out and protect your online data. It is not guaranteed, though, that your data will be eliminated permanently. To improve your privacy, you can move to PurePrivacy and opt-out of multiple data brokers without doing it manually.