Table of Content

Do you ever wonder why you are pre-approved for credit cards you never use?

Innovis, a business you've probably never heard of, could be behind those intrusive credit requests.

Cloud-stored data accounts for 82% of data breaches. 39% of breaches occur across different environments, with an average cost of $4.75 million.

But do not worry—there is a way to fight back such data brokers. In this post, we'll teach you exactly how to opt out of Innovis and regain control of your email.

Key Takeaways

- Despite its lower recognition, Innovis is the fourth-largest US credit bureau, showcasing its significant role in finance.

- Innovis, a data broker, may have your personal data and raise privacy concerns. Stay informed and proactively protect your data.

- Opting out of data brokers like Innovis is wise for protecting personal information. While the opt-out form may request sensitive details, providing them is optional.

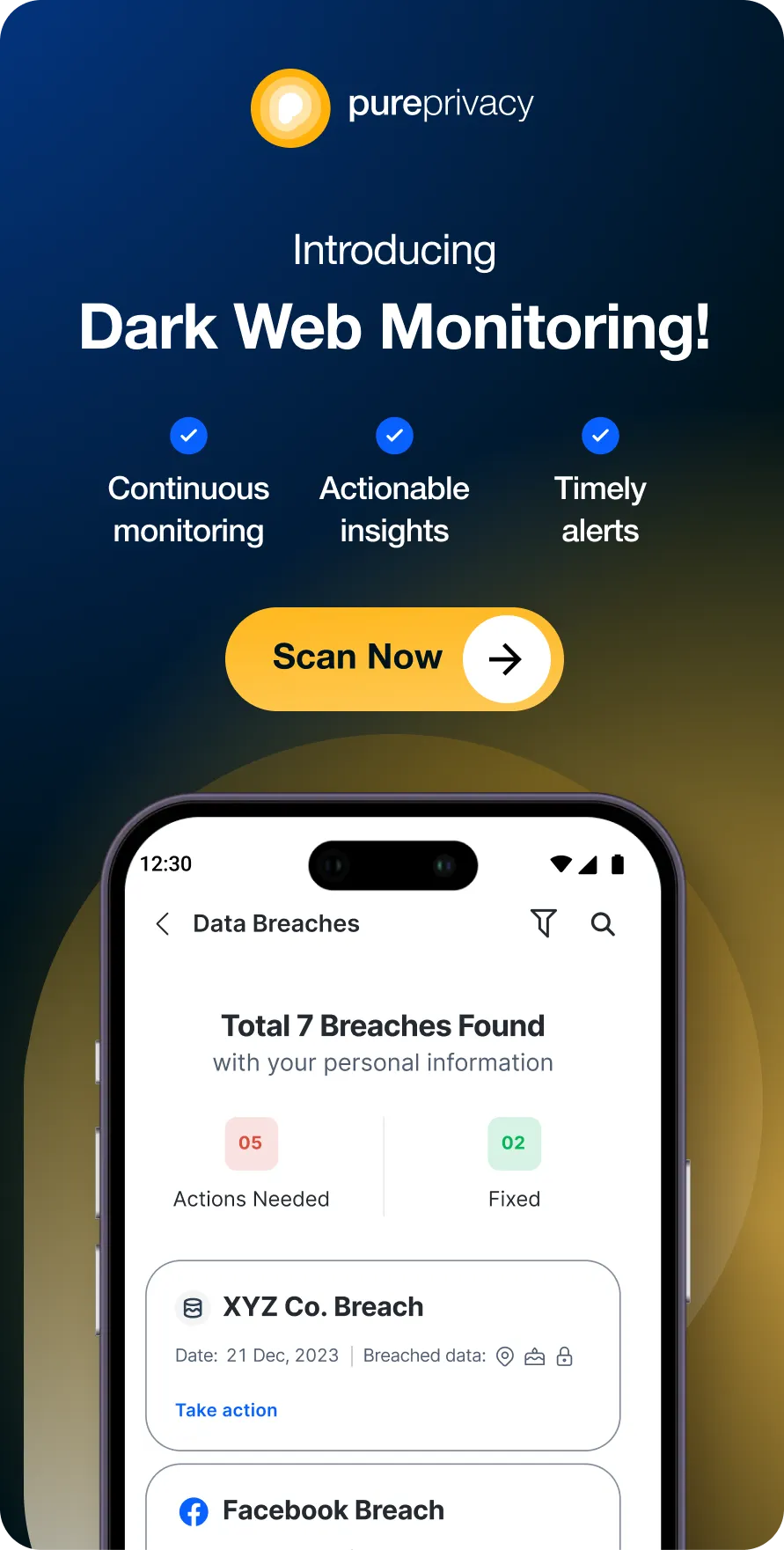

- Explore how PurePrivacy enhances online privacy by eliminating data broker databases.

What is Innovis?

Innovis, which is sometimes overshadowed by the major three (Experian, TransUnion, and Equifax), is the fourth credit reporting bureau in the US. Though less commonly utilized, it still influences your credit score.

Similarly to the big three, Innovis provides credit information, fraud protection, and identity verification services. You can check your free Innovis report once a year and contest any inaccuracies you find.

How Does Innovis Collect Your Data

Innovis collects your data in a few different ways:

From Other Companies

Innovis typically obtains your information from financial product and service providers, such as lenders and credit card firms.

Personal Information

If you contact Innovis regarding your credit report or utilize their website, you may provide certain information. For example, they may gather your name, email address, and details about your interactions with them.

They also gather some information automatically when you visit their website, such as your IP address and the sites you visit.

How to Opt-Out of Innovis Manually

If you want to opt out and remove your data from Innovis manually, follow these steps:

Step 1: Scroll down to the bottom of the page. Hit "CLICK HERE TO OPT-IN OR OPT-OUT." Then select the "Permanent Opt-Out by Mail" option. Hit Enter.

Step 2: Select "CONFIRM" once you've added all the relevant details.

Step 3: You’ll receive a confirmation notification to opt out and end the session.

Step 4: The session has ended, and opt-out is in process.

Making the choice: Innovis vs. PurePrivacy for privacy solutions

- Manually opting out involves visiting each website or data broker and determining their opt-out process.

- Manually opting out can be challenging. Some websites may have buried opt-out links or unclear instructions.

- Finding all the data brokers who hold your information can be difficult.

- Once you actively opt out, there is no guarantee that the data broker will not acquire your information again.

- PurePrivacy automates this procedure by looking for your data and processing opt-out requests on your behalf.

- It is familiar with these opt-out procedures and has navigated them effectively.

- It maintains a comprehensive database of data brokers and analyzes new ones periodically.

- PurePrivacy can provide ongoing tracking and re-opt-outs as necessary.

Frequently Asked Questions

-

What happens when you opt out of Innovis?

Opting out of Innovis limits marketing, boosts privacy by excluding your data, and involves a request on their website. Verification may be needed, and the process doesn't affect other credit bureaus.

-

How long does it take for the Innovis opt-out process to take effect?

The exact timeframe for the Innovis opt-out process to take effect can vary. Generally, it may take a few weeks for the opt-out request to be fully processed and reflected in their systems. It's advisable to review Innovis's specific policies and contact them directly for the most accurate information on the processing timeline.

-

How does opting out of Innovis impact my data privacy?

Opting out of Innovis enhances your privacy by excluding your data, and reducing targeted marketing. Consider similar opt-outs with other entities for comprehensive privacy control. Review Innovis's policies for details.

-

What is the difference between freeze and opt-out?

A credit freeze enhances security against identity theft by restricting credit report access. Opting out reduces marketing communications and provides more control over the use of personal data for marketing purposes. Choose based on your priorities, or consider both for comprehensive protection.

Make a Better Privacy Decision!

Understanding Innovis' opt-out process allows you to make smarter choices about your data privacy.

By following the procedures mentioned below, you can control how Innovis gathers and uses your information.

Remember that opting out may limit the services or personalization you receive, so consider the advantages and disadvantages before making a decision.

References

- https://techjury.net/blog/customer-loyalty-statistics/