Table of Content

- Key Takeaways

- What Is SageStream?

- SageStream's Data Collection Techniques: Are They Legitimate?

- How SageStream Uses Your Personal Information?

- Why Opting Out of SageStream Is Important?

- The Great SageStream Escape Plan: How To Remove Your Data the Easy Way

- Method 1: The Basic SageStream Opt-out Procedure

- Method 2: Opt Out with PurePrivacy - Opt Out of SageStream and Other Data Brokers in Seconds

- Frequently Asked Questions

- Take the Bold Opt-Out Step Now

- References

More than 220 million Americans fell victim to data breaches in the first nine months of 2023 alone. A significant number of these incidents stem from the unethical behavior of data brokerage companies, with SageStream being a major player. Here's everything you need to know about Sage Stream Opt Out/

Leaving your personal details on platforms like SageStream puts you at serious risk, as scammers and identity thieves could exploit this information. You definitely don’t want to be their next target. Fortunately, you can take action—explore these SageStream opt-out methods to remove your data and protect your privacy online.

Key Takeaways

- SageStream is a CRA that gathers and sells your personal data to businesses.

- Your data and that of others are what powers SageStream’s entire operation.

- The only way to protect the sale and misuse of your personal information is to opt out.

- You can opt out manually or automatically using PurePrivacy.

What Is SageStream?

The Fair Credit Reporting Act (FCRA) governs SageStream, LLC, which is a company that offers credit reports and scores. The company has become an integral part of LexisNexis® Risk Solutions, a provider of information solutions for businesses and governments to predict and mitigate risks.

SageStream is very important to the financial system. Companies use their credit reports and scores to make informed decisions about their customers. Furthermore, SageStream protects individuals from identity theft.

There might, however, be some doubt over the security of data contained in SageStream’s database. With data breaches being commonplace in contemporary life, this concern comes as no surprise. That is the reason why you need to do what is necessary to protect your data.

SageStream's Data Collection Techniques: Are They Legitimate?

SageStream gathers data from diverse records, including court proceedings and tax lien notifications. They use this information for the creation of your credit report.

Some specific examples of how SageStream collects your data are as follows:

- Whenever you pay on a credit account, SageStream gets updated information about your credit report from credit bureaus.

- Your data is sourced by SageStream from the credit bureaus when you open a new account.

- In case you file for bankruptcy, all of your bankruptcy information shall become public knowledge, and SageStream can access it.

How SageStream Uses Your Personal Information?

SageStream's information solutions are used by a variety of businesses and governments, including:

- Credit card issuers

- Retailers

- Wireless telephone service providers

- Auto lenders

- Banks

- Mortgage lenders

- Landlords

- Employers

- Government agencies

Why Opting Out of SageStream Is Important?

Opting out of SageStream and other data brokers has many great benefits, including:

- It will help you reclaim your data and privacy rights.

- Your personal information will no longer be a puppet in the hands of data brokers.

- You will no longer be affected by data breaches on SageStream.

- Your personal information will be protected from scammers, identity thieves, and cybercriminals.

The Great SageStream Escape Plan: How To Remove Your Data the Easy Way

It is always unpleasant to think that confidential data is managed by information providers like SageStream. Though some data is useful for business, it does not come without privacy concerns, which can cause some doubts.

Luckily, you can opt out of SageStream if you feel that your personal information may be compromised. You can permanently opt out of receiving unsolicited credit or insurance offers by following a detailed procedure.

Opting out of SageStream can be done either manually or automatically. This may include any of these two methods:

- The basic SageStream opt-out procedure (Manual)

- PurePrivacy opt-out procedure (Automated)

Method 1: The Basic SageStream Opt-out Procedure

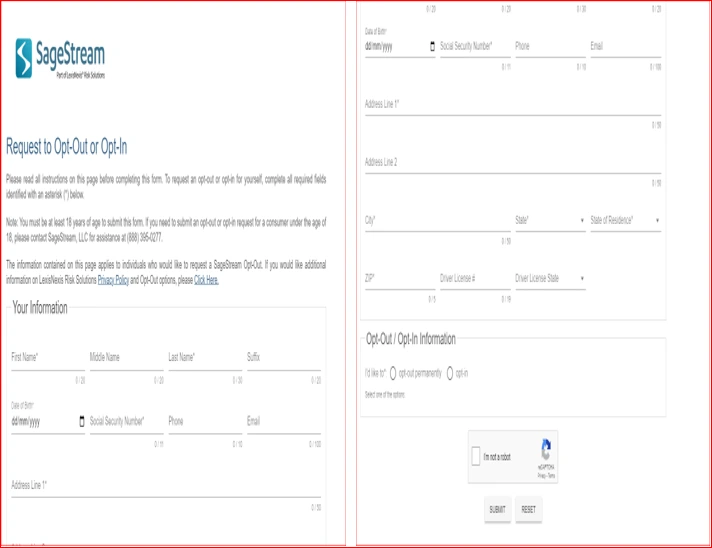

To opt out of SageStream manually, you can follow these steps:

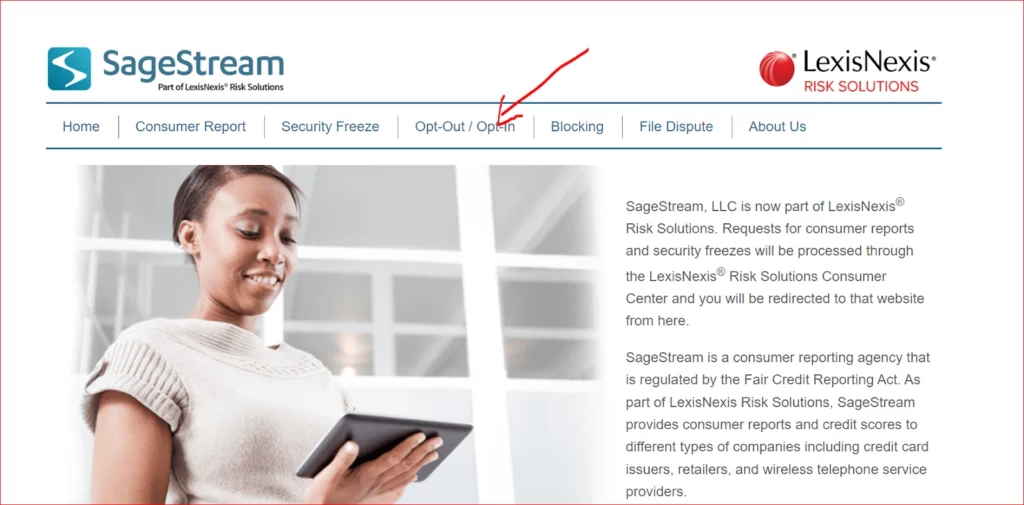

Step 1: Visit the official website of SageStream

- Visit SageStream’s official website.

- On top of the page, you will find the “Opt Out / Opt In” section. Click on it.

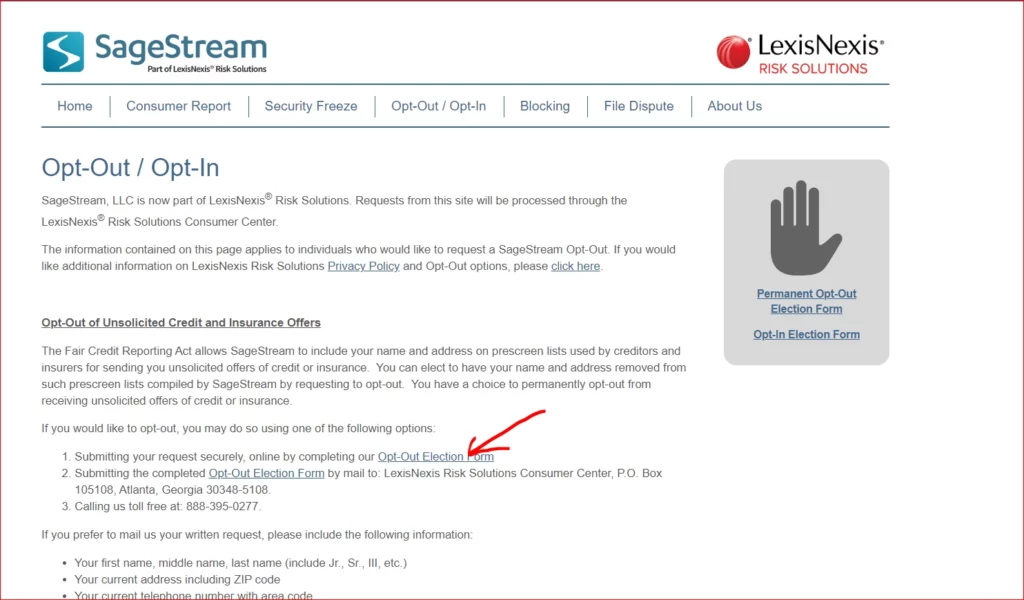

Step 2: Click the Opt-Out Election Form

- On the Opt Out / Opt-In page, read the instructions and then click the link labeled "Opt-Out Election Form."

Step 3: Fill form

- Input all of your details in the opt-out form.

- You have two options- permanent opt-in or out. You will find this at the bottom of the page

- To opt-out permanently, pick the second option.

When you are done filling out the form, check the Captcha box, then click the “Submit” button. Your choice will be effective days after you have completed this procedure.

Alternatively, you can also opt out of SageStream by mail:

- Print out the SageStream opt-out form: https://forms.sagestreamllc.com/#/opt-self

- Complete the form with all the information asked for.

- Send the form through mail to the following address:

LexisNexis Risk Solutions Consumer Center

P.O. Box 105108

Atlanta, Georgia 30348-5108

Note: SageStream claims that your choice will take effect no later than five business days after they receive it. However, this may not always be the case, as it can take weeks to take effect. Nevertheless, once your opt-out request has been processed, SageStream will no longer give your information to businesses for prescreened credit and insurance offers.

Method 2: Opt Out with PurePrivacy - Opt Out of SageStream and Other Data Brokers in Seconds

As detailed above, opting out of SageStream manually can be tasking. What if I tell you that you no longer have to go through that rigorous process to remove your data from SageStream?

Yeah, that’s right!

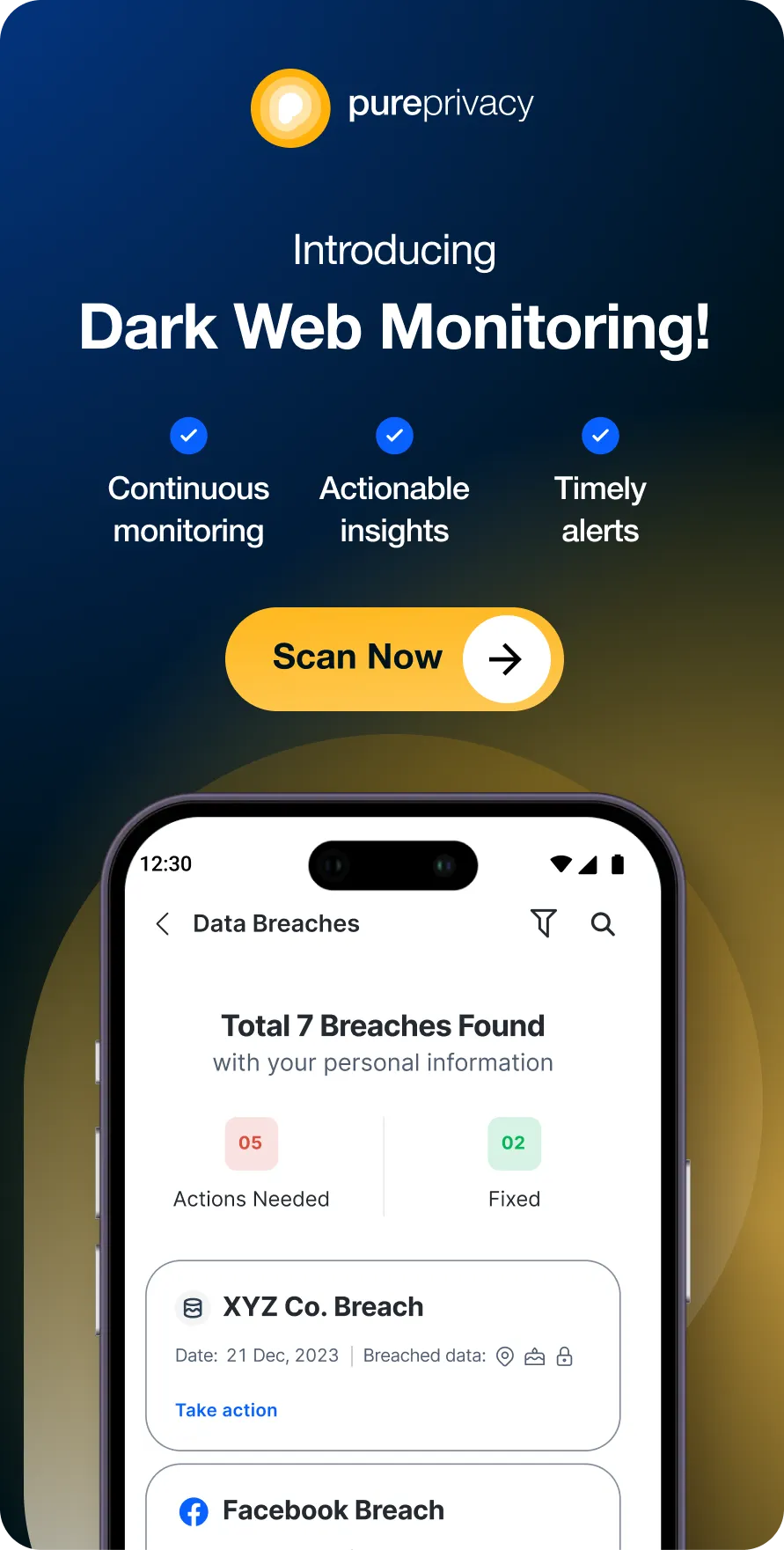

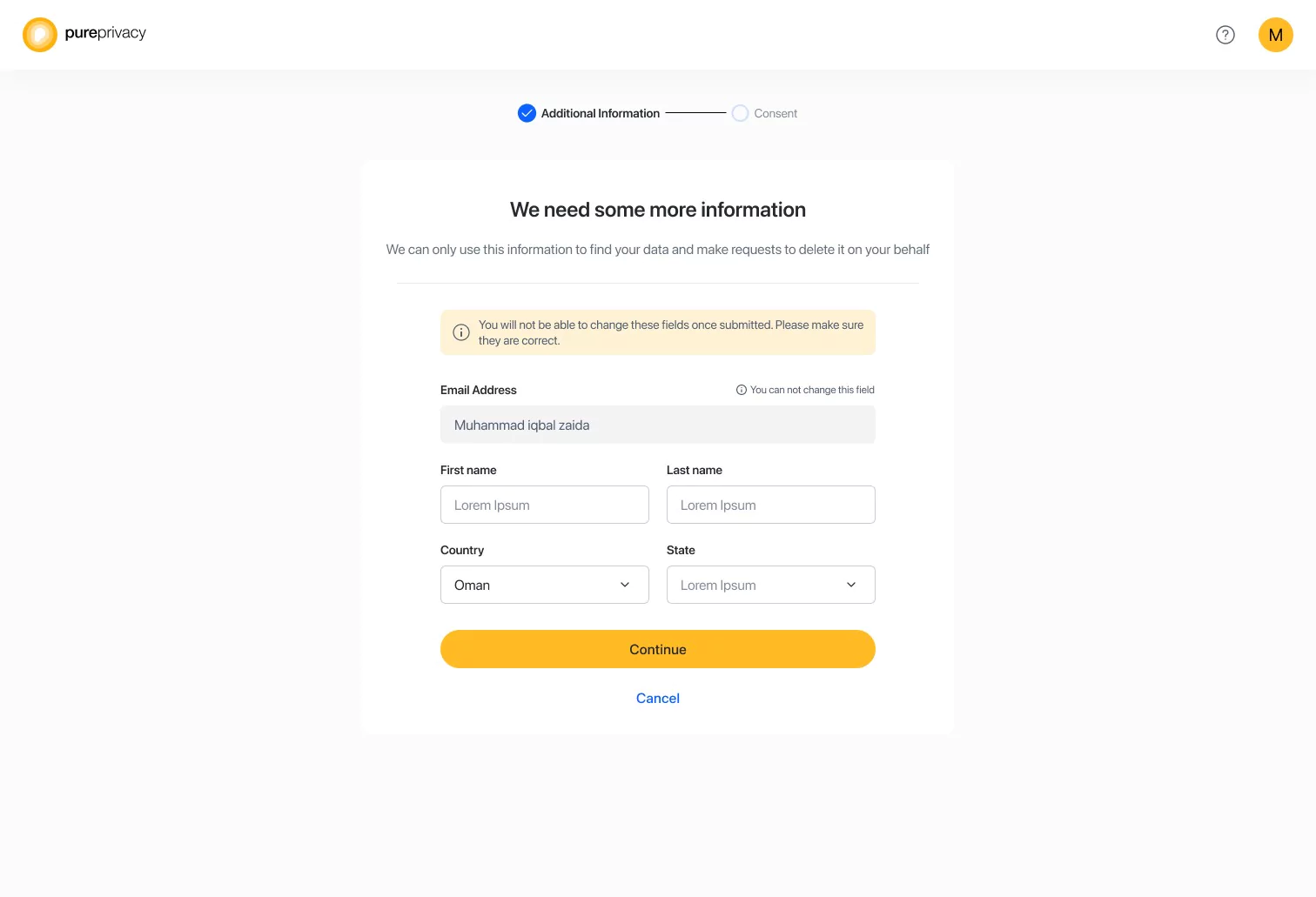

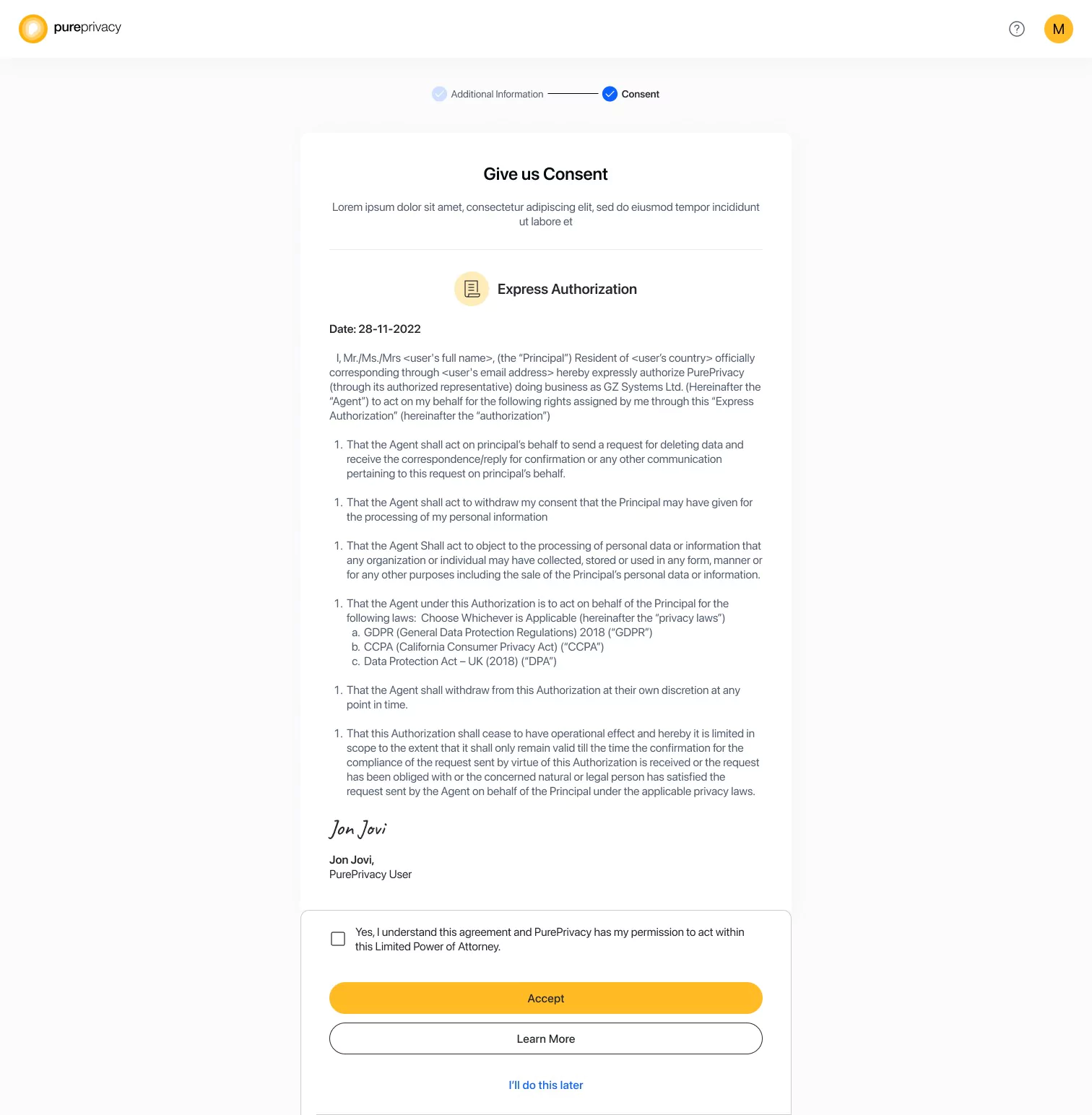

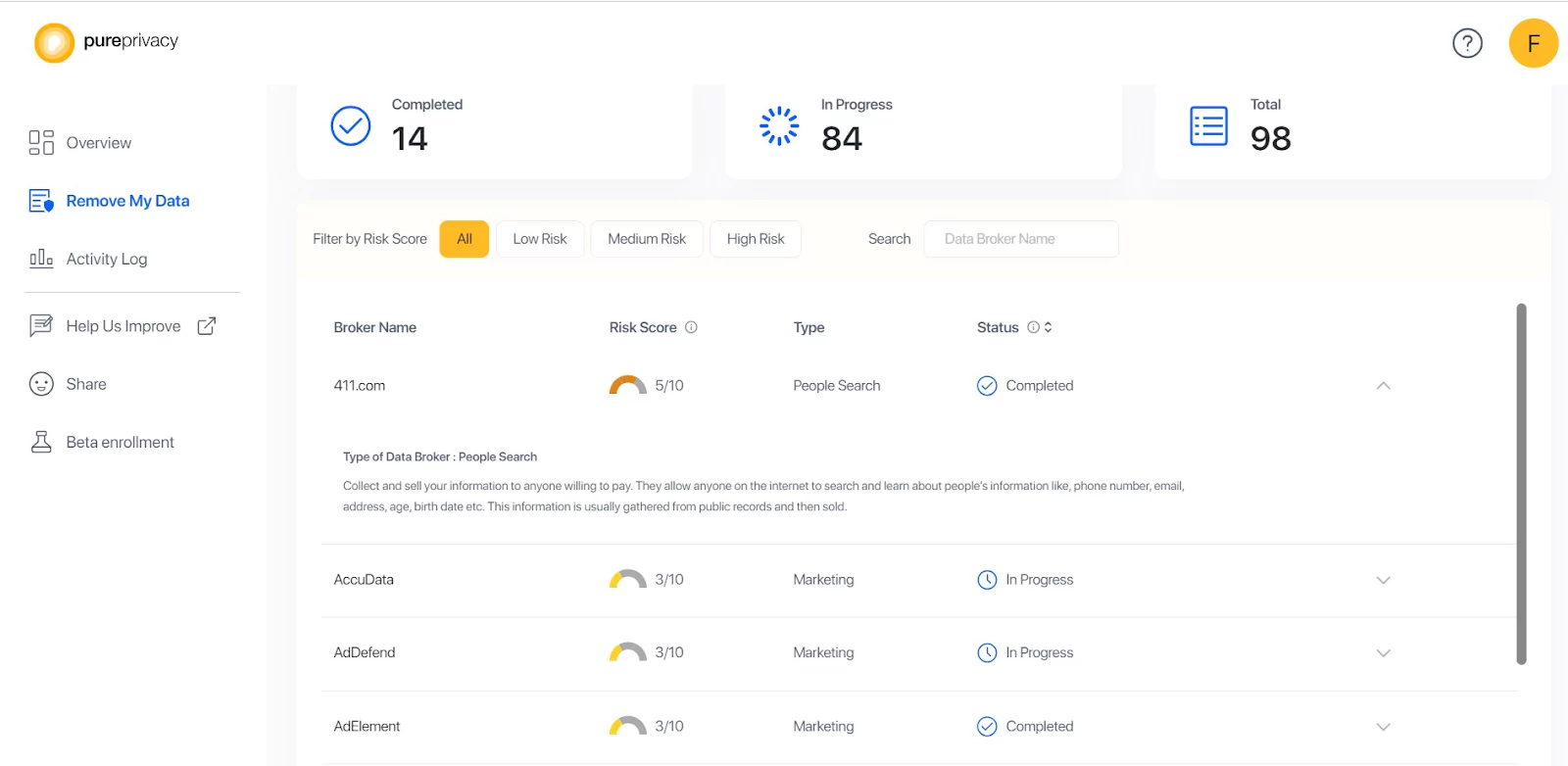

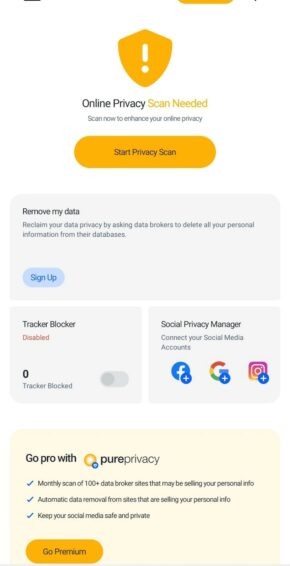

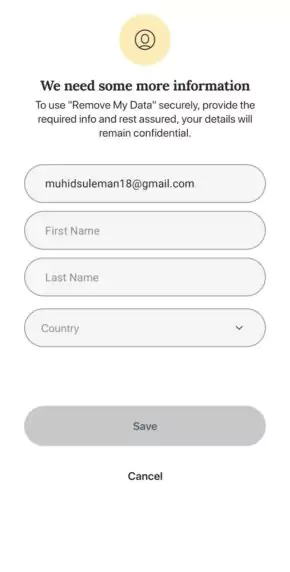

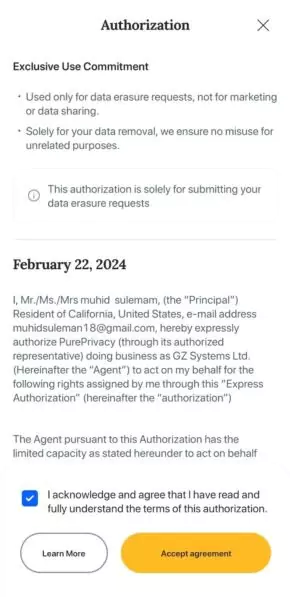

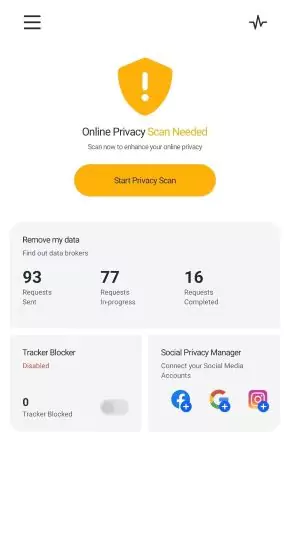

You can opt out of SageStream and dozens of other data brokers with PurePrivacy. Download the app or go to their official website, use the free account or opt for a premium plan, and grant consent; the tool will take it from there.

Some of the benefits of using PurePrivacy are:

- Social Media Privacy: social media is one place where we give out sensitive information without knowing. PurePrivacy will optimize your social media accounts to recommend settings that will prevent you from giving out vital information and protect your digital privacy.

- Full Control over Your Data: You can bid farewell to the days when you have little to no control over your data, thanks to PurePrivacy. This tool will put you in the driver’s seat of your data, giving you full control over it.

- SageStream Opt-Out Vs PurePrivacy

How to Use PurePrivacy to Opt-Out

- Visit the official website of SageStream

- Click the Opt-Out Election Form

- Fill out the form

- Requires just a few clicks on the app

- Ability to opt out of multiple data broker websites within seconds

- You do not need to fill out any forms or mail anything in

- Track the opt-out process to make sure it is completed successfully

More to explore in Opt-Out

- Epsilon.com Opt Out

- Experian Opt Out

- Equifax Opt Out

- Epsilon.com Opt Out

- Acxiom Opt Out

- CoreLogic Opt-out

- Apollo.io Opt Out

- RocketReach Opt Out

Frequently Asked Questions

-

What is SageStream, and why should I opt out of it?

SageStream is a credit reporting agency that collects and sells your personal information to businesses. You may opt out if you're concerned about your personal information being used for prescreened credit or insurance offers or if you value your online privacy.

-

In what way is SageStream similar to the Fair Credit Reporting Act (FCRA)?

The Fair Credit Reporting Act is the Federal law in the United States concerned with gathering, relaying, and utilizing consumer data, including credit reports. SageStream operates under the FCRA.

-

Where does SageStream get its information, and what is it?

SageStream gathers data from different originators like court proceedings, tax lien notifications, and credit bureaus whenever one creates a new credit account.

-

Is there a free option in SageStream?

No, SageStream does not have a free plan to facilitate access to personal information but offers free consumer reports annually as required by the Fair Credit Reporting Act.

-

How can one tell whether his details are in SageStream?

Get a complimentary consumer report yearly by giving your info and proof of identity to confirm if you have data in SageStream. Additionally, you can contact them for more information about it.

-

Is there a cost to opt out of SageStream?

Opting out of SageStream is completely free and doesn’t come with any fees.

You have several ways to opt out:

Fill out their online Opt-Out Election Form

Mail your request to SageStream

Contact them through their toll-free number

Alternatively, services like Incogni can simplify the process by helping you opt out of multiple data brokers at once. These services usually charge a fee, either monthly or annually, depending on the service and the protection plan you choose.

Take the Bold Opt-Out Step Now

A fraud victim loses an average of $500, which results in billions of dollars yearly. I’m sure you don’t want to fall victim to some scams or have your identity stolen. Opting out of SageStream and other data brokers is the only way to ensure your digital safety.

The manual opt-out method works sometimes. But I highly recommend using PurePrivacy, as it is faster, easier, more convenient, and more reliable. It can help you remove your data from all data brokers, all in under a minute.

References

- https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act

- https://www.sagestreamllc.com/about-us/index.html#:~:text=SageStream%2C%20LLC%20is%20a%20credit,them%20predict%20and%20manage%20risk

- https://www.sagestreamllc.com/

- https://www.pureprivacy.com/